Astera Labs IPO: S-1 Teardown

How the newly public $10B+ semiconductor connectivity player in AI servers is changing the data center

While the IPO market has been deafeningly quiet after a few false flags in Instacart, Klaviyo and Reddit, another $10B+ company quietly went public at over 50X revenue. Enter Astera Labs, whose connectivity chips have quietly been included in nearly all AI servers being deployed in 2024.

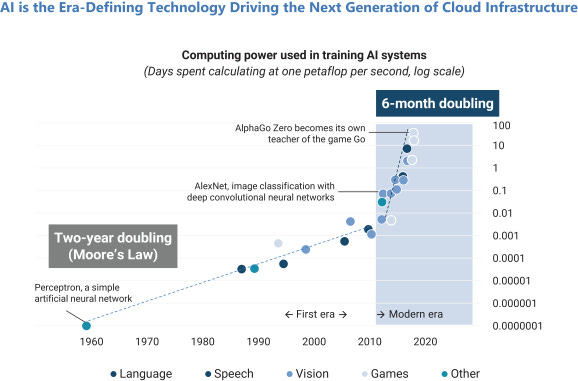

“With today’s AI models exceeding one trillion parameters and AI clusters spanning thousands of GPUs, the bottleneck for AI deployments in the cloud has shifted from computing performance to connectivity. Today, expensive GPUs in large AI clusters sit idle for half the time, waiting for data. Increasing the utilization of AI hardware presents a large challenge, as well as a massive opportunity for Astera Labs. Now, more than ever, we feel confident that we made the right bet.”

— Jitendra @ Astera Labs, co-founder

Broadcom and Marvel historically have dominated the connectivity market. The data connectivity market has traditionally served 3 core customer types: major hyperscalers, leading AI accelerator vendors (including GPU vendors), and system OEMs

Founding Story

Astera Labs was founded in 2017 in Santa Clara, by Jitendra Mohan, Sanjay Gajendra and Casey Morrison. The three founders met at Texas Instruments, where they worked on high-speed data center connectivity solutions.

Identifying a common challenge in the tech industry—the increasing connectivity bottlenecks in data centers due to the rapid growth in computing and storage requirements—the team decided to venture out on their own. They aimed to create solutions that could improve data transfer speeds and processing power for businesses relying heavily on data center operations. Starting in a garage, a nod to the humble beginnings of many Silicon Valley startups, Astera Labs focused on developing technology that could address these critical efficiency issues in data centers.

“We, the founders, were convinced of the promise of AI back in 2017, during the early innings of the AI Era. We believed that AI models would grow large enough to be practical only at cloud-scale. We bet that an exponential growth in AI processing power would be constrained by a fundamental problem: connecting powerful compute elements (e.g., GPUs) at a massive scale to tackle large, distributed AI workloads. While many other companies were focused on building accelerators with unprecedented compute, we decided to address the problem of connecting all of them to deliver the full performance of an AI cluster.”

— Jitendra @ Astera Labs, co-founder

Impressively, the $10B company only has 267 employeers, 80%+ of which are in the US, 10% in Canada and 10% split across Taiwan, China and Israel.

Product Overview

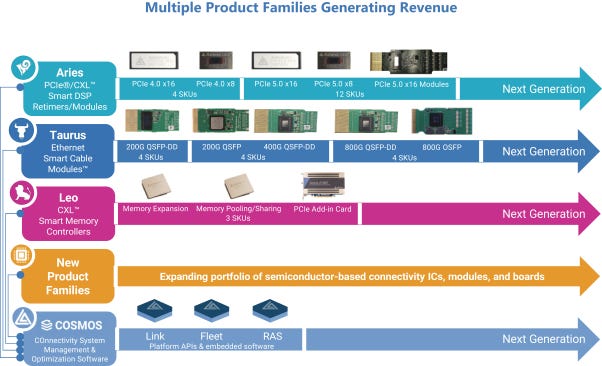

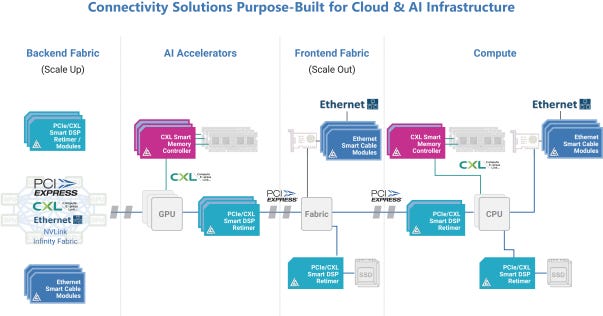

Astera has 3 core product lines, with Aries its data I/O bandwidth solution being the beachhead product:

Aries, which helps CPUs and GPUs scale their data I/O bandwidth; (~90%+ of revenue)

Taurus, which provides AI servers with faster network bandwidth; (<5% of revenue)

Leo, which enables CPUs and GPUs to easily scale their memory bandwidth and capacity. (<5% of revenue)

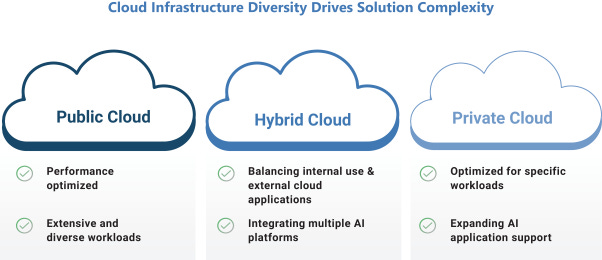

Astera Labs created the industry-first Aries Smart Retimer for PCIe 4.0 and 5.0, which went to market beginning in 2019. The team states that after it resolves one connectivity bottleneck, “it often turns the spotlight on another, and we continue to march alongside our customers, developing new product families to unlock the true potential of AI”. Astera highlights the needs for different solutions to support different cloud environments.

Astera’s founders tell the story that the latest GenAI models now have up to 1 trillion parameters and are trained on trillions of training tokens (i.e. data inputs).

To address the performance and scalability requirements of AI and other compute-intensive applications, hyperscalers have adopted heterogeneous, “accelerated computing” architectures to target specific workloads. AI accelerators such as GPUs, TPUs, and FPGAs, with their massively parallel compute engines and high bandwidth connectivity to memory and data, are foundational to the AI infrastructure. A typical accelerated computing server consists of multiple AI accelerators (for example, eight in NVIDIA’s HGX platform) connected to a head node which comprises CPUs (two in NVIDIA’s DGX platform), together with multiple NICs (ten in NVIDIA’s DGX).

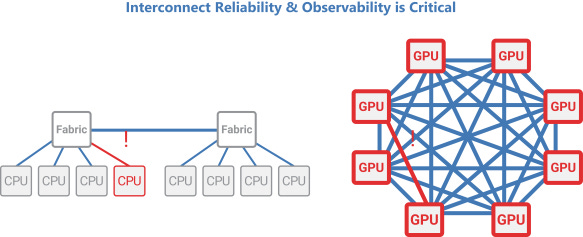

To address increasingly larger and more complex AI workloads, hyperscalers interconnect tens of thousands of GPUs and other AI accelerators that process workloads in parallel across thousands of servers to increase system compute capacity. Put simply, the data center has become the modern computer for AI workloads. With the increased complexity, reliability and connectivity have become of increasing performance in workloads like AI training.

If you’d like to read more about the key technologies that Astera addresses such as PCIe, CXL, Retimers and redrivers, and Smart Cable Modules, I highly recommend checking out the Semi Analysis piece here and reading the Astera Labs S-1.

Financial Highlights

Astera grew revenue 59% YoY and is projected to accelerate in 2024

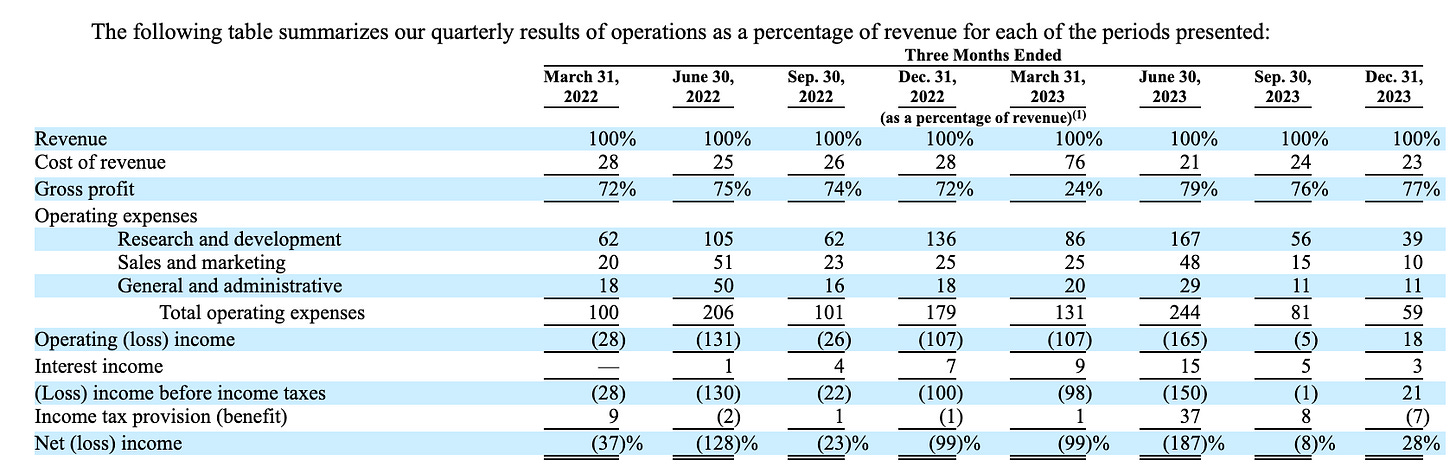

Astera operates at ~77-80% gross margins, with COGs going to third-party fabs

In Q4 2023, Astera posted its first positive net income quarter — demonstrating 21% EBITDA margins

As we have previously stated, semiconductor companies are R&D intensive, much moreso than software companies. Its biggest costs are thus in R&D, where it spends ~39% of revenue and roughly 10% each in S&M and G&A.

Board of directors

Astera Labs has an 8-person board, consisting of 4 executive officers and 4 non-employee directors. Sutter Hill Ventures and Fidelity Management and Research, owning 13.7% and 7.0% of the company, respectively.

Named executive officers and directors such as Jitendra Mohan, Sanjay Gajendra, and Manuel Alba hold 6.6%, 5.4%, and 3.3% respectively, with Stefan Dyckerhoff also at 13.7%. Collectively, all directors and executive officers own 29.4%. It’s unclear who owns the other 70% of the company, but this most certainly consists of employees and other investors.

Executive team:

Jitendra Mohan is Astera Labs' co-founder, CEO, and board member since November 2017, previously serving as President, with a background in electrical engineering from IIT Bombay and Stanford University, and experience at Texas Instruments and National Semiconductor.

Sanjay Gajendra co-founded Astera Labs, serving as COO and board member since November 2017, and President since November 2023, bringing experience from Texas Instruments, National Semiconductor, and Wipro Limited.

Michael Tate, Astera Labs' CFO and Treasurer since July 2020, brings a wealth of experience from his advisory roles and executive positions at Annapurna Labs, NetLogic MicroSystems, Marvell Technology, and Galileo Technology, holding a BSc in Accounting from California Polytechnic State University, San Luis Obispo.

Philip Mazzara joined Astera Labs as General Counsel and Secretary in September 2022, with a legal background from Stanford Law School and the Stanford Graduate School of Business, and experience at Innovium, Inc.

Non executive board members:

Manuel Alba, Chair of Astera Labs' Board since March 2018, with a diverse background in electrical engineering and business administration from universities in Mexico and the US, brings extensive experience from his roles at Copperleaf Technologies, Kardium, Lightbits, Xsight Labs, and Lyte.ai.

Stefan Dyckerhoff has been a board member since November 2019, a Managing Director at Sutter Hill Ventures, with a history at Juniper Networks and Cisco Systems, and board positions at Lacework, SiFive, Atmosic Technologies, and Enfabrica, educated at Duke University and Stanford University.

Michael Hurlston joined the board in November 2022, currently leading Synaptics, Inc. as President and CEO, with a history at Finisar Corporation, Broadcom Limited, and various senior positions in the semiconductor industry, holding degrees in Electrical Engineering and an MBA from the University of California, Davis.

Jack Lazar became a board member in December 2022, an independent business consultant with a storied career including CFO of GoPro, Inc., and roles at Qualcomm Incorporated and Atheros Communications, Inc., serving on several boards, with a BSc in Commerce from Santa Clara University.

Conclusion

Astera Labs' IPO valuation at over 50x trailing revenue and over $10B+ total market cap reflects remarkable investor confidence in the quality of its business and its growth trajectory. Astera is seeing strong demand for its data center connectivity solutions, particularly in AI server environments where its solutions are included in over 80% of new shipments in 2023.

The company's product portfolio for the AI server market underscores its competitive edge and positions it well to benefit from increased spending in cloud infrastructure and AI-first data centers

With AI and cloud computing witnessing exponential growth, Astera Labs is expected to experience sustained tailwinds, as its products are essential for the high-speed, reliable connectivity that modern AI servers demand.

The successful IPO showcases market optimism for Astera Labs' future, with its technological advancements and strategic market positioning indicating the potential for continued revenue growth and market share expansion.

Congratulations to the Astera Labs team on your successful IPO—a monumental achievement in just seven years. The story from small Santa Clara startup to a key industry player in AI server connectivity is inspiring.