"Start-up Nation": An incomplete history and profile of Israel's rise in Cybersecurity

Covering the origins of Israel's cybersecurity ecosystem, including key companies, rising stars, notable acquisitions, and key ecosystem players

The startup ecosystem frequently highlights three primary hubs leading the forefront of innovation: 1) Silicon Valley, 2) New York, and 3) Tel Aviv. Each hub has evolved around distinct themes. Silicon Valley, initially rooted in silicon and semiconductors, progressed to pioneer databases, networking, the internet, cloud computing, and mobile. New York has become a conduit for financial services and connections to Fortune 2000s (historically the largest IT purchasers) and the broader global market, particularly Europe and Asia. This positioning has made NYC a natural hub for fintech and commerce (e.g., Bloomberg and Etsy), along with some infrastructure companies (e.g., MongoDB). NYC serves as a gateway for startups from Europe and Israel, like Datadog and Snyk who setup headquarters in the US at growth stage.

Perhaps most unexpectedly of the Big 3 startup ecosystems, Tel Aviv has emerged as a key player. Tel Aviv’s rise is particularly notable in cybersecurity (alongside semiconductor innovations from companies such as Mellanox, now part of Nvidia), earning it recognition as the unofficial global capital of cybersecurity innovation despite Israel's relatively small population of around 10 million. The factors behind Tel Aviv's ascendancy in cybersecurity, though not as frequently explored, stem from a mix of government support, research prowess, technological breakthroughs, and a distinct entrepreneurial culture. We will explore these elements further below.

Source: Generated with DALL-E

History: Origins of Israeli Cybersecurity

Israel’s transformation into a top startup ecosystem, often referred to as the “Start-up Nation” (based on this book) is a result of deliberate policies, cultural factors and educational investments. A number of factors led to its success, but key factors were government initiatives, military innovation, education and research institutions, IP protections, and global integration detailed below:

Government Initiatives and Funding

Chief Scientist’s Office (Now the Israel Innovation Authority): Created as a government body responsible for the country’s innovation policies, it offers a variety of programs to support starts — from initial R&D to global expansion. Aimed at reducing risk for entrepreneurs, the program includes grants and loans with conditions often tied to the company’s success.

Yozma Program [link]: Launched in 1993, the Yozma Program (Hebrew for “initiative”) was a first of its kind initiative aimed at jumpstarting Israel’s VC ecosystem. Yozma offered attractive tax incentives to foreign investors. More importantly and boldly, Israel matched private capital 1:1 with government funds, effectively doubling the capital available to Israeli startups. Yozma’s success is evidenced by its eventual privatization and the significant growth of Israel’s VC sector, showing some parallels to the early days of Silicon Valley with research grants and government funding paving the way for the silicon era. Spawning 39 Global IPOs, 50 acquisitions, and 24 technology incubators, the program was a massive boon for the Israeli tech economy.

Elite Military Units

Under constant attacks and threats since its founding, Israel’s military has always been forced to stay at the bleeding edge. With compulsory service for males (32 months) and females (2 years), the country has one of the largest active-duty and reservist militaries in the world. Units such as 8200 (read more) and Talpiot (read more), known for intelligence and cybersecurity, service as high-tech incubators within the military, where young personnel gain advanced technological training and experience. The cadets of Talpiot study for their B Sc. in physics, math or compute science at the Hebrew University in Jerusalem. The alumni networks of these units are strong and supportive, often acting as a springboard for founders. See below for companies founded by alumni of 8200:

Source: Wikipedia, Unit 8200 [link]

Many technologies developed in the military are translated into private markets. In addition to cybersecurity, other sectors such as AI and ML, Big Data, Drones and Unmanned Systems all had key innovations developed in the military that birthed large private technology companies.

Education and Research Institutions

Often referred to as Israel’s MIT, the Technion has a renowned engineering and computer science department. Founded in 1912 in Haifa under the dominion of the Ottoman Empire, the Technion is the oldest university in the country with four Nobel laureates and plethora of iconic startup founders.

The Weizmann Insitute is known for its contributions in biotech, chemistry, physics and computer science. Other top universities include the Hebrew University of Jerusalem (known for its contributions in computer science research) and Tel Aviv University (known for its vibrant startup culture)

Culture and Legal Environment of Entrepreneurship

The Israeli government has regulatory protections on intellectual property that encourage investment in R&D, key for sectors like cybersecurity and biotech where IP is the key asset. Israel has business-friendly policies and efforts to reduce bureaucracy and streamline business processes for starting a company in Israel. Tax incentives for R&D and technology exports also are favorable.

The government also offers programs and assistance for startups looking to expand internationally, including market research, legal advice and matchmaking with potential partners and investors abroad.

Israel is known for its startup community, including frequent networking events, hackathons, professional meetups and accelerators. Networking and mentorship are highly valued.

Israeli culture is characterized by a high tolerance for risk and an understanding that failure is part of the entrepreneurial journey. Founders are generally highly technical but also commercial and based on market feedback from customers. The business culture in Israel is notably direct and informal, which is straightforward.

Global Integration

From day one, Israeli startups aim for larger markets, with the US being the primary due to its size and openness and Europe being nearby. Israeli founders are multilingual and multicultural.

With 71 venture capital firms that are based outside of Israel having a major office in the country, Israeli startups have a strong advantage in working with partners who can establish presence in other global markets. Israel has over 250 venture firms in total.

The 1990s: Check Point as the O.G. of Israel’s Cybersecurity Ecosystem

While a number of companies paved the way for the Israeli cybersecurity ecosystem, Check Point is widely considered the “OG” founded in 1993 with others following in the late 1990s and 2000s. Its alumni have created one of the most powerful flywheel effects in all of technology.

Pictured: Shlomo Kramer (left), Marius Nacht (center) and Gil Shwed (right), co-founders of Check Point, from Calcalist

Check Point made its mark for developing the first firewall and has since expanded its offerings to include a wide range of cybersecurity solutions, including VPN, endpoint security, cloud security and more.

The Company had 3 founders:

Gil Shwed who is still CEO and is worth $4.4B for his 19.1% stake in the public company. He is on the board of Trustees at Tel Aviv University and recently announced a transition from CEO to Chairman.

Shlomo Kramer who is perhaps the single most influential figure in all of Israel’s startup economy and called “the godfather of Israeli Cybersecurity” having backed more than 60 companies. After founding Imperva, he later went on to found Cato Networks (detailed below) and became a founding investor of many iconic companies.

Marius Nacht who led Check Point for over 26 years with Gil as Chairman and co-founder.

Founding story: Shwed founded Check Point with Shlomo Kramer, his friend from the military unit 8200 and Marius Nacht. Shlomo and Gil Shwed are perhaps best thought of as the “founding fathers” of Israel’s cybersecurity ecosystem.

Detailed: Some of the 40+ companies founded by Check Point alumni

Source: The power of the Check Point Mafia [link]

The “Check Point” mafia is one of the most impressive and under-discussed talent networks in the world:

Shlomo Kramer became a serial founder, creating Imperva (acquired by Thoma Bravo for $2.1B) and Cato Networks (valued at $2.5B in 2021). He is involved with many of Israel’s most iconic companies, including Gong, Palo Alto Networks and Sumo Logic. Per Pitchbook, Shlomo has made more than 60 personal investments including as a founding investor and board member.

Former principal engineer Nir Zuk served as Chief Security Technologist at Juniper Networks (a marquee dotcom networking company, recently acquired by HPE for $14B) and later became founder and CTO of Palo Alto Networks (the $100B+ giant in cybersecurity)

Almog Cohen, former security expert at Check Point, became a CTO and co-founder of Sentinel One (a $9B public security company)

Avi Shua, former Chief Technologist at Check Point, is now a co-founder and CEO of Orca Security (valued at $1.8B in 2021)

Dozens more detailed in “The Power of the Check Point Mafia”

The two other major companies developed around this era are CyberArk (now a $10B public company) and Imperva (acquired by Thoma Bravo for $2.1B)

Mickey Boodaei (one of the founders of Imperva) became a key leader in the ecosystem. After founding Imperva, he founded Trusteer with Shlomo Kramer which was acquired for $1B by IBM. He later went on to found Transmit Security (detailed below) where he is still CEO.

Udi (co-founder of Cyberark) and Mickey (co-founder of Imperva and Transmit) became closely involved with Cyberstarts, a key VC detailed below

Check Point vs. Palo Alto Networks: The Great Rivalry in Israeli Cybersecurity

Check Point alum Nir Zuk went on to co-found Palo Alto Networks in 2005, which became the largest cybersecurity company globally today valued at over $100B. Zuk was one of Check Point's earliest employees and departed contentiously in 1999 due to disagreements with Gil Shwed, the founder and CEO who has managed the Check Point since its inception in 1993. This split created a fierce rivalry and competition between Check Point and Palo Alto Networks in the 2000s that still lives on today. A great piece that highlights some of the tension from 2020 is “Nir Zuk slams Check Point’s lack of ambition”.

While Zuk’s PANW was headquartered in Santa Clara, the Company maintained a strong presence in Israel organically and through acquisitions. The Israeli center is its second largest, following the development center in Santa Clara. Further, hiring in Israel is outpacing hiring in the US and India, showing its importance to the security giant’s future growth prospects. In 2023, Zuk stated that PANW’s Israeli offices surpassed $1.5B in revenue, with the Cortex division led by Gonen Fink reporting over $1B of revenue and the Prisma Cloud product line reaching $500M of ARR.

Nir Zuk (founder, board member and CTO, and Palo Alto Networks CEO Nikesh Arora

The 2010s to 2020: The Cloud Era of Israeli Cybersecurity

After the firewall era defined by Check Point and Palo Alto Networks, a new cohort of founders took on new challenges in cybersecurity. This time, founders had an ecosystem of other cybersecurity experts. In the 2010s and early 2020s, Israel became the powerhouse of cybersecurity it is today — leading technical innovations in new categories like cloud security, developer security and SASE. The stars included:

Wiz [link]:

Wiz co-founders Assaf Rappaport (from left), Ami Luttwak, Yinon Costica and Roy Reznik.

Founding story:

Founded less than 4 years ago, Wiz quickly became the largest private cybersecurity company and is considered to be a rising platform security company — mentioned alongside extremely elite company of market leaders Palo Alto Networks, Zscaler and Crowdstrike.

Wiz was established in March 2020 by founders Rappaport (CEO), Ami Luttwak (CTO), Yinon Costica (VP of Product), and Roy Reznik (VP of R&D). Prior to founding Wiz, Rappaport served as the General Manager of R&D at Microsoft Israel, following the sale of his earlier venture, Adallom, to Microsoft for $320 million in 2015. The co-founders of Wiz have a long-standing collaboration with Rappaport, dating back to their military service in 8200, and also held various positions at Adallom.

Wiz was incubated by Cyberstarts and is a crown jewel of the Israeli cybersecurity startup ecosystem.

Traction:

Wiz reached over $100M in ARR just 18 months after launching its product and is rapidly approaching $500M of ARR today, recently valued at $10B.

Trusted by more than 40% of the F100, the Company has out-executed incumbents in the new category of cloud security.

Read more about Wiz’s founding story from Contrary Research

Snyk [link]

Founding story:

Founded in 2015, initially split across Tel Aviv and London, Snyk was a pioneer of “devSec” a major trend that created a new class of companies. The Company was established with the mission of making open-source software more secure for enterprises (notably addressing the reliance on libraries and the vulnerabilities they often contained).

The company was co-founded by Guy Podjarny (formerly CTO of Akamai), Assaf Hefetz, and Danny Grander (formerly CTO of Cognyte, acquired by Verint).

In its early days, Snyk focused on building a developer-first platform that could integrate seamlessly into existing development workflows. The founders' emphasis on developer experience and automation helped Snyk gain early traction and stand out in a crowded cybersecurity market.

Traction:

Snyk raised at a valuation of $7.4B in 2022 and was originally backed by Boldstart in its seed financing.

The Company surpassed $200M of ARR in 2023 and in 2022, more than doubled and achieved 130% net revenue retention.

SentinelOne [link]

Founding story:

SentinelOne was founded in 2013 by Almog Cohen (formerly of Check Point), Tomer Weingarten, and Ehud Shamir (also formerly of Check Point).

The team set out with a vision to redefine endpoint security through a unique approach that combined AI-driven threat detection, automated response, and a holistic view of the enterprise network.

The founders identified a gap in the traditional antivirus market, where legacy solutions were failing to keep up with the rapidly evolving threat landscape. SentinelOne quickly gained recognition for its ability to stop advanced threats, including zero-day and ransomware attacks, without human intervention.

Traction:

Today SentinelOne is a nearly $10B public company with ARR of $664M growing 42% YoY.

Cato Networks [link]

Shlomo Kramer, co-founder of Cato Networks and formerly Check Point

Founding story:

Cato Networks was founded in 2015 by none other than Shlomo Kramer and Gur Shatz. Kramer, co-founder of Check Point Software Technologies and Imperva, teamed up with Shatz, who brought extensive cloud networking expertise as the co-founder and CEO of Incapsula, to create a new kind of network security company.

Cato Networks introduced the world's first Secure Access Service Edge (SASE) platform, aiming to modernize and secure enterprise networks and cloud environments. By converging network and security into a cloud-native service, Cato Networks sought to address the growing complexity and security challenges faced by businesses adopting cloud.

Traction:

Cato Networks surpassed $100M of ARR in 2022 in just five years since founding, a record pace that was the fastest ever for a cybersecurity company until Wiz broke the record shortly after.

Cato is backed by Greylock, Coatue, Lightspeed and Kramer himself

Today, dozens of such enterprises spend more than $250,000 in annual recurring revenue (ARR) with Cato, an increase of 163% year-over-year, and several global enterprises spend over $1 million in ARR.

Rising stars of today’s startups

Notably, while many founding stories start in Israel, the majority of Israel’s major winners expand to the US and even become US-headquartered — a win-win for commercialization and global expansion. As of 2023, the US is home to the headquarters of >85% if Israeli-founded unicorns — with California having ~40% followed by NY at 35% and Massachusetts at 12% [source].

In the past couple of years, Israel has trailed only the US in # of new unicorns, a feat that is truly incredible considering the size of the country:

Source: Viola Ventures data [link]

Far from exhaustive, below are some of the rising stars of Israel’s new cohort of cybersecurity companies:

Cyera [link]: Cyera, founded in 2021, specializes in data security by helping companies secure their data across cloud environments. The company has raised about $53 million in funding from Cyberstarts and Redpoint. Its solutions were created for data protection and compliance in the era of cloud computing.

Fireblocks [link]: Founded in 2018, Fireblocks offers a secure platform for the transfer, storage, and issuance of digital assets, catering to the financial and crypto sectors. With over $1 billion in funding from Cyberstarts and a plethora of growth funds, Fireblocks plays a crucial role in securing the digital asset infrastructure.

Island [link]: Island, established in 2020, has developed the Enterprise Browser, which provides organizations with enhanced control, visibility, and security over enterprise web usage. With around $115 million in funding from Cyberstarts and Sequoia, Island emphasizes the importance of secure and manageable web browsing in the enterprise environment.

Transmit Security [link]: Founded in 2014 by Imperva co-founder Mickey Boodaei and Rakesh Loonkar, Transmit Security focuses on identity and access management, offering solutions to enable secure customer identity and access management at scale. They have raised approximately $543 million in funding predominantly from the founders, Cyberstarts and Insight Partners, showcasing their significant contribution to improving authentication processes and user experience in cybersecurity.

BigID [link]: Founded in 2016, BigID focuses on data intelligence for privacy and protection, offering advanced solutions for managing personal and sensitive data in compliance with privacy regulations. Having raised over $200 million in funding from Boldstart and a variety of growth firms, BigID underscores the escalating demand for robust data privacy and protection tools in the digital age.

Axonius [link]: Axonius, established in 2017, provides a cybersecurity asset management platform that helps organizations manage and secure their IT assets. With approximately $195 million in funding from Bessemer, YL and others, Axonius addresses the increasing complexity of managing a diverse array of devices and software in the cybersecurity domain.

Notable acquisitions and exits

Also far from exhaustive, below are some of the notable Israeli cybersecurity acquisitions of the past few years:

Talon Cyber Security - Founded in 2021 and acquired for $625 million by Palo Alto Networks, maker of a corporate browser that competes with Island

Armis Security — Founded in 2015 and acquired by Insight Partners for $1.1B, maker of IoT Security

Perimeter 81 - Founded in 2018 and acquired for $490 million by Check Point, maker of security service edge (SSE) solutions

Axis Security - Founded in 2018 and acquired for an estimated $400 million by Hewlett Packard Enterprise (through Aruba), also a maker of security service edge solutions

Bionic - Founded in 2018 and acquired for an estimated $350 million by CrowdStrike, maker of IT security operations and monitoring platform

Twistlock — Founded in 2015 and acquired for an estimated $410 by Palo Alto Networks, maker of vulnerability management and compliance platform for container infrastructure

Demisto — Founded in 2015 and acquired for $560M by Palo Alto Networks in March 2019, maker of security orchestration, automation and response (SOAR)

Key investors behind the scenes

While dozens of firms have emerged to support the Israeli cybersecurity ecosystem, a few standout for significant contributions and a huge amount of winners:

Cyberstarts: Founded by Gili Raanan who formerly led Sequoia’s Israel practice, Cyberstarts has had incredible success in just a few years since its founding and focusing on seed and series A exclusively in cybersecurity. The firm was the first backer of Wiz (the $10B+ cloud security leader) as well as a number of other market leaders like Transmit Security, Island, Cyera, Fireblocks, Bionic, and Noname Security. Many of the leading Israeli security founders and CISO operators are involved with Cyberstarts.

Team8: Builder in-house (incubations) and seed investor, across enterprise, cyber, AI and fintech. Notable cyber companies include Claroty, Curv (acquired by Paypal), Dig Security (acquired by PANW), Talon Security (acquired by PANW), and Gem Security.

YL Ventures: A seed stage focused firm, YL Ventures exclusively focuses on cybersecurity and has backed companies like Orca Security, Axonius, Twistlock, and many others. See their full portfolio here. Creators of CyberMap, a live map of Israel’s cybersecurity startup landscape.

In addition to these venture firms, Israel’s cybersecurity ecosystem has a few “super-angels” who are often “founding investors”. Two that standout for a huge amount of unicorns and are both former founders mentioned above:

Shlomo Kramer who needs no introduction as we have discussed above. In addition to founding Check Point, Imperva and Cato Networks, Shlomo has invested in over 60 companies including Palo Alto Networks, Sumo Logic, Gong, Trusteer, Aqua Security, Forescout and many others

Mickey Boodaei who as previously mentioned founded Imperva and Trusteer and backed Armis Security, Preempt Security and many others.

Early-stage Market Dynamics

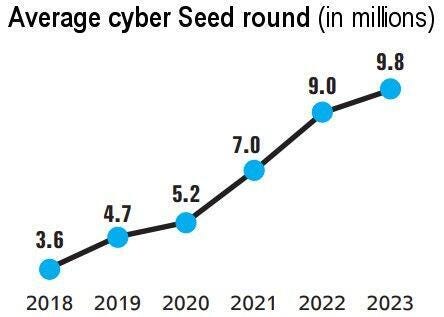

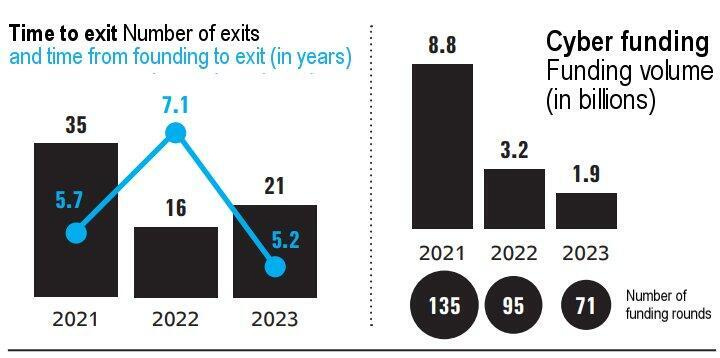

The early-stage venture market in Israel is unique. Some key stats from YL Ventures State of Cyber report include an average cybersecurity seed round of $9.8M (much larger than a typical seed in Silicon Valley, as Israeli founders tend to prefer more cash at higher dilution) and a median time to exit of 5.2 years (much faster than other industries, showing the nature of many 9-figure acquisitions in cyber).

YL highlights that the acquirers of cybersecurity companies are increasingly not purely cybersecurity-focused:

Further reading

This piece is far from exhaustive and other players domiciled in Israel have some great research. In addition, there are some great books and movies on the topic of Israel’s startup ecosystem.

Calcalist “What if Shwed had managed Check Point more like Zuk’s Palo Alto Networks?”

Start-up Nation (book)

Zero Days, a 2016 documentary on Stuxnet used against Iranian centrifuges

Israel’s Edge: The Story of the IDF’s Most Elite Unit Talpiot (book)