Synopsys' $35B Bid for Ansys: A Strategic Move in AI Chip Design and Auto, Aerospace and Engineering

Adding simulation to Synopsys' EDA product portfolio for semiconductors

Perhaps a bit under the radar, Synopsys made a $35 billion bid to acquire Ansys. This deal would mark the 3rd largest enterprise acquisition in the past few years — behind only Broadcom’s $61B acquisition of VMWare and AMD’s $49B acquisition of Xilinx. The $35 billion offer for Ansys marks a significant shift in the semiconductor design and simulation landscape. This move is more than a financial headline; it's a strategic alignment of two quiet software leaders that highlights the growing complexity of chip design for AI and other semiconductor engineering (automotive, aerospace, energy, etc.).

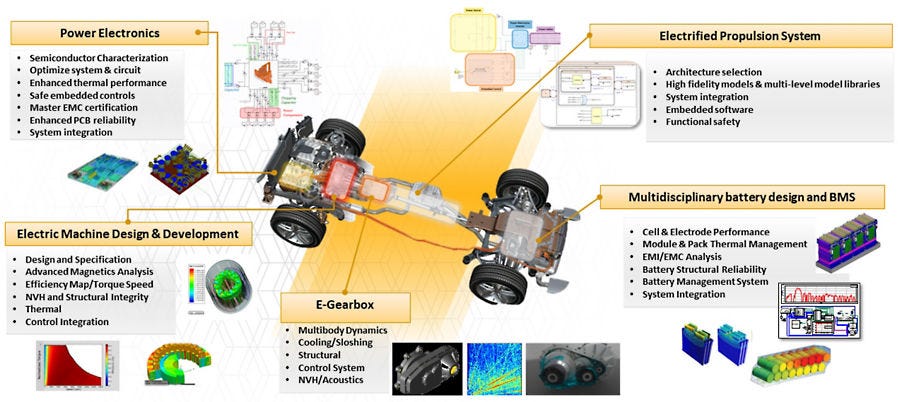

At the heart of this acquisition is the complementary nature of the products offered by Synopsys and Ansys. Synopsys has established itself as a powerhouse in semiconductor design, providing essential tools for designing and testing integrated circuits. Ansys, on the other hand, excels in a different, albeit related, arena: engineering simulation software. As semiconductor designs become more complex (with AI, 5G and IoT and chips everywhere), the need for accurate simulation to predict performance under various physical conditions (like heat, stress, and electromagnetic interference) becomes more critical. Semiconductors have broadened in reach from the data center and PC into aerospace, defense, automotive, healthcare, industrial and more.

By integrating Ansys’ simulation capabilities with its own design tools, Synopsys can offer a more comprehensive solution that spans the entire development lifecycle of a semiconductor, from design to simulation to testing.

Synopsys: Overview

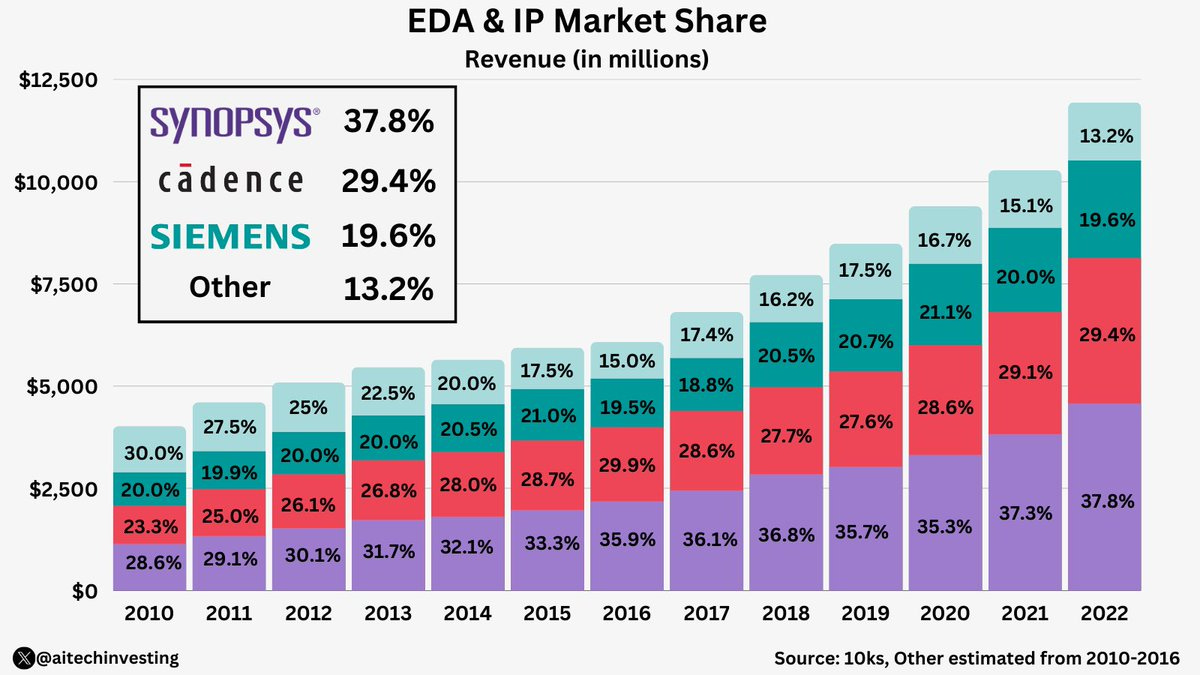

Founded in 1986, Synopsys (SNPS 0.00%↑) is the largest pureplay software company serving the semiconductor industry, with its Electronic Design Automation (EDA) software tooling providing the essential tools for designing and testing integrated circuits. EDA has given rise to trillions of dollars of semiconductor companies and the first trillion dollar semi company in Nvidia. The $75B+ giant based in Mountain View operates in an effective duopoly with Cadence (CDNS 0.00%↑), the $71B giant based in San Jose. These two heavyweights in Silicon Valley are fierce competitors and perhaps have some of the largest moats in all of software — with advanced proprietary software and deep industry expertise in EDA, coupled with long-standing relationships with major semiconductor manufacturers and early IP of new semiconductor innovations.

Synopsys' product portfolio is diverse, encompassing solutions for system-on-chip (SoC) design, verification, IP integration, and software security and quality testing. These tools are integral to the development of complex semiconductor chips, found in a wide range of electronic devices. Synopsys' relevance in the field of AI is particularly noteworthy. The company's EDA tools and semiconductor IP play a crucial role in designing AI chips, which are essential for processing complex AI algorithms efficiently. This is evident in the growing demand for AI accelerators, specialized processors designed to speed up AI applications, where Synopsys' tools enable faster and more efficient design and testing. In addition to the data center, Synopsys services networking, mobile/5G, automotive, AR/VR, healthcare, industrial, memory, PC/gaming, financial services, government and aerospace.

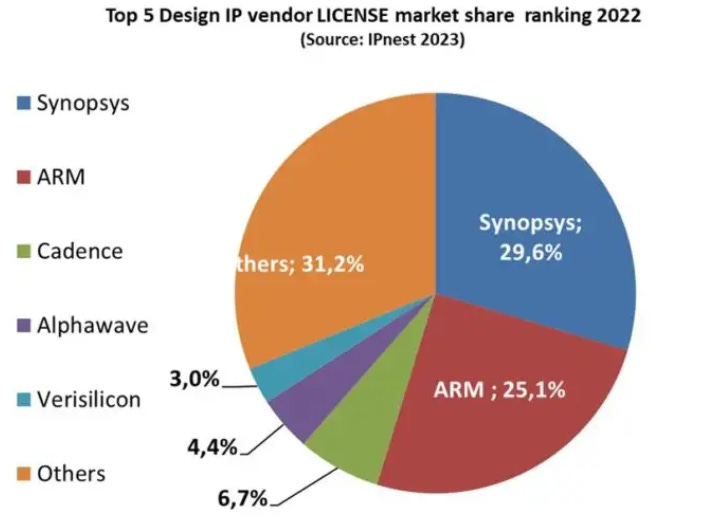

In the most recent quarter, Synopsys reported $6.4B of annualized revenue, up 25% YoY at 80%+ gross margins with $2B+ of annualized operating income. The Company has a 56% Rule of 40 score and its stock is up 473% in the past 5 years alone. The Company’s customer base is extensive and surprisingly diversified away from industry concentration in semiconductors with only one customer >10% of revenue. Its customer base contains all of the top 20 semiconductor companies in the world —Nvidia, Broadcom, TSMC, Intel, AMD, etc. 45% of its revenue comes from systems companies, which develop chips as an input to an end product, rather than selling the chip itself — showing how Synopsys is deep within the full supply chain of semiconductors. Synopsys is also the #2 player in IP for chip design, the reusable building blocks that are used for chip designs, where it supplies the interface, memory, analog and physical IP — second to only ARM.

Source: IPNest

Ansys: Overview

Founded in 1970, Ansys (ANSS 0.00%↑) is one of the oldest and longest standing companies in software. Ansys focuses on hard engineering simulations, covering areas such as structural analysis, fluid dynamics, electromagnetics, as well as overlapping with Synopsys in areas like electronics and semiconductors.

These tools are pivotal for industries like aerospace, automtive, energy, electronics and healthcare where they enable engineers to test and validate designs virtually, significantly reducing the need for physical prototypes. Ansys’s customer base includes companies like Tesla, SpaceX, Lockheed Martin, Boeing, BMW, Honeywell, Siemens, Samsung and more which depend on its simulation capabilities for product development and optimization. Ansys as of Q3 is approaching $2.0B of annualized revenue, up 13% YoY and at 37% operating margins. Its stock is up 129% in the past 5 years.

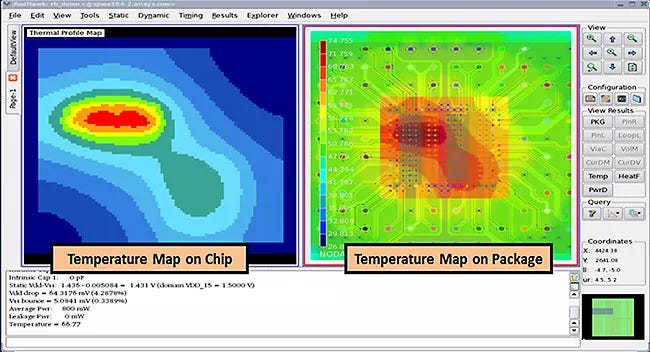

Ansys' overlap with Synopsys primarily lies in the field of semiconductor and electronics design. Both companies provide crucial tools for the electronics industry, with Synopsys specializing in Electronic Design Automation (EDA) and Ansys in engineering simulation. In the realm of semiconductor design, Ansys' simulation software complements Synopsys' EDA tools, enabling integrated circuit designers to not only create complex chip designs but also simulate and analyze their physical properties, like thermal effects, stress, and electromagnetic interference. This synergy becomes increasingly relevant in the age of AI, where chip performance in complex environments and reliability are paramount. Ansys' expertise in simulating real-world environments adds significant value to the chip design process, making it a crucial component in the ecosystem where Synopsys also operates.

Accelerating AI Semiconductor Design

The amount of work required to design a leading edge chip has gone up by 30-40X according to the CEO of Cadence, while the amount of time spent in EDA software tools has gone up 10X. With the advent of reinforcement learning, there’s been significant automations in the automation of changes in design specs. Today, we have ~100B transistors on the most complex chips and by the end of the decade, it will be 1 trillion transistors — so size is going up 10X and the amount of work an order of magnitude more — 30-40X+ per Cadence. Chip design teams aren’t able to grow headcount by this much, so are increasingly investing in automation.

With this increased complexity comes much more uncertain environments for chips — from heat to other simulations, it’s become increasingly important to invest in automation. Cadence had the foresight to invest in its simulation product, which has garnered strong support in AI.

Synopsys' willingness to pay a premium to acquire Ansys for AI semiconductor design and simulation stems from the strategic value Ansys brings in enhancing AI chip development. AI semiconductors require intricate design and extensive testing due to their complexity and performance requirements. Ansys' advanced simulation tools can significantly improve the accuracy and efficiency of this process. By integrating Ansys’ capabilities, Synopsys would not only streamline the design-to-production pipeline for AI chips but also position itself as a leader in this rapidly growing sector, where efficient and reliable AI chip design is increasingly critical for technological advancements.

"Analyzing the dynamic voltage drop in highly complex chips has always been a challenge. Using sigmaDVD simulation technique by Ansys, it is possible to generate tens of thousands of unique switching scenarios and a higher coverage of IR-drop hotspots."

- Anusha Vemuri, Physical Design Methodology Engineer, Nvidia

Broadening Customer Base and Synergies of combining Engineering and Simulation

While there is some overlap today in the customer bases of Synopsys and Ansys, the overlap is only growing with increasing prevalence of semiconductors in traditionally engineering oriented industries like automotive, aerospace and healthcare. Synopsys boasts the entirety of the top 20 in the semiconductor design industry, while Ansys serves a broader engineering market with companies like Tesla, Lockheed Martin and SpaceX as well as semiconductor companies like Nvidia using Ansys for complex simulations on novel chips.

Both the broader customer base in traditional engineering sectors where semiconductors are being introduced, as well as complex AI-first chips that require engineering are highly desirable attributes for Synopsys. The acquisition opens up new markets and cross-selling opportunities, allowing Synopsys to penetrate further into industries like automotive and aerospace, while Ansys can expand its reach in the semiconductor sector for AI. Bundling EDA and simulation will differentiate Synopsys from Cadence and increase its functionality.

Competition with Cadence by catching up on Simulation

In the effective duopoly of EDA tools and semiconductor design, Synopsys’ main rival has been Cadence. At a $71B market capitalization, with ~$4.1B of annualized revenue growing 15% YoY at 90% gross margins and 31% operating margins — Cadence is a highly profitable competitor. A few years ago, Cadence made its foray into simulation software and expanded from its base in EDA. Like Synopsys, Cadence services nearly all of the top 20 semiconductor companies like Broadcom, Nvidia, TSMC, etc. as well as large technology companies like Apple, Google and Microsoft. Cadence’s expansion into simulation gave the company some advantages in automotive and AI, where chips need to be designed and simulated in complex environments.

Source: link

The primary barriers to entry or moats for Cadence and Synopsys are their advanced proprietary technologies and deep industry expertise in electronic design automation (EDA), coupled with long-standing relationships with major semiconductor manufacturers and a comprehensive portfolio of intellectual property. New IP from semiconductor companies runs through Synopsys and Cadence first, effectively barring competitor EDA companies from even seeing the latest research in the semiconductor industry. These factors create a high entry barrier for new competitors and solidify their duopoly in the semiconductor design and EDA sectors. Siemens also competes in the market, though its share has been declining and the Company is mainly used for verticals like healthcare.

By acquiring Ansys, Synopsys can significantly bolster its capabilities, particularly in simulation—a field where Cadence also competes but where Ansys has distinct expertise. This move could give Synopsys an edge in offering a more comprehensive suite of tools, making it a one-stop-shop for semiconductor design and simulation, thereby enhancing its competitive stance against Cadence in the fierce EDA duopoly. These tools are the key products used to commercialize core IP for chip design.

If you are innovating in the world of chip design software, I would love to chat. Special thanks to Kartik from Chipstack for great conversations on the topic. Congrats on your seed round!

Great article! Performing a market report on this space and the insights are incredibly useful!

Another great article Chris, will be interesting to see if any legitimate synergies result from the acquisition. On the surface, continued consolidation of the EDA space makes a lot of sense.