The Financialization of the Data Center: GPU Clouds, Debt and PE fueling AI infrastructure supercycle

From GPU Clouds like Coreweave to PE like Blackstone, a new wave of primarily debt capital is fueling exponential data center investment

Over the past decade, data center buying activity and capital investment has heavily concentrated into the Big 3 Clouds: Microsoft Azure, Amazon AWS, Google GCP. While some enterprises have built private data centers alongside third-party data center operators like Equinix, the trend has undoubtedly been towards Big 3 consolidation and outsourcing to public cloud.

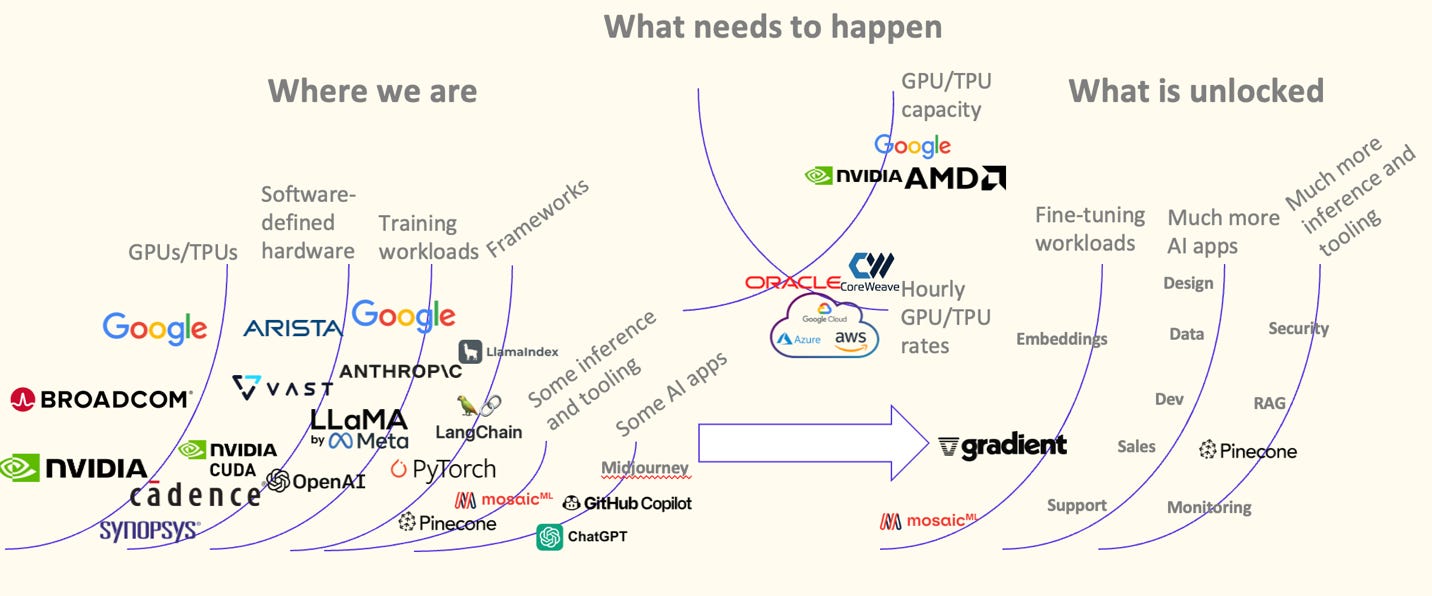

However, with the rise of the GPU and AI-first workloads, dozens of new entrants have brought billions of net new capital to data center investment — and been chipping away at cloud market share with AI workloads.

From GPU Clouds offering competitive GPU rates for the latest chips, to joint ventures with private equity firms like Blackstone and data center operators (i.e. Digital Realty, QTS, Equinix): a new wave of buyers are investing in data center infrastructure for AI. Over $20B of investment has already been announced between these two groups. We discuss both below.

The Rise of the GPU Cloud

Outside of the Big 3 clouds, the major story of the reinvention of the data center is the $5B+ of debt and equity that GPU cloud providers have raised to compete for AI workloads. Today, most of these AI workloads are training but will increasingly shift towards inference.

Is the use of debt to buy GPU infrastructure for insatiable AI workload demand sustainable? Hard to say. This will depend on GPU hourly rates and depreciation schedules. Coreweave and others are mitigating GPU rate risk by having enterprises commit to 4-5 year contract cycles. The major GPU infra players are:

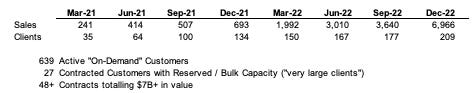

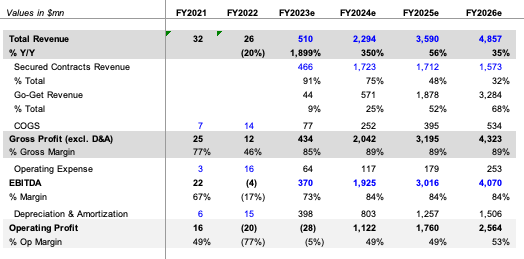

Coreweave: Originally an Ethereum mining service using its GPUs for cryptography, Coreweave has become the most dominant new player in the world of GPU clouds. The Company even secured backing from NVIDIA, Fidelity, Blackstone and Magnetar and has achieved a massive $7B valuation in just 2-3 years since becoming a GPU Cloud.

Coreweave grew revenue from $30M in 2022 to over $500M this year and has nearly $2B in contracted revenue for 2024. The Company has over $10B of total bookings with ~4-5 year contracts and pricing its deals for a certain payback on GPU infra. Coreweave has raised in total over $3.5B to build out its data centers such as its $1.6B data center in Plano, TX. Most of its capital will go towards GPUs and was raised predominantly in the form of debt, backed by precommitted purchase agreements by customers.

Coreweave believes its bare metal architecture and no-hypervisor approach will allow 40-60% performance improvements over clouds like Microsoft and AWS. The Company runs its training clusters in the same data centers for performance, while inference can be multi-cloud.

The biggest variables for its return on GPU spend are: 1) GPU hourly rates (currently $2.11 per hour for 3 year contracts); 2) Depreciation schedule of GPUs (Coreweave believes 5 year useful life on GPUs is reasonable, though we will see as NVIDIA moves to 1 year upgrade cycles on its premier GPUs)

Lambda: The #2 pureplay GPU cloud, Lambda has raised $372M at most recently a $1.55B valuation and secured huge amounts of GPUs. Lambda is quoted for projecting $250M of revenue for 2023. The Company is 11 years old, suggesting this was quite the pivot almost 8 years in. The Company has a blue chip set of customers.

Lambda is one of NVIDIA’s 5 preferential buyers of GPUs, and one of the first to receive H100s. Notably, both Adam D’Angelo and Greg Brockman from the OpenAI board are investors in the company. Lambda is working with Equinix on codeveloping these data centers, with Equinix’s cloud offerings enabling Lambda to spin up GPU services and enterprises to consume those services securely in real time. Lambda also leverages Platform Equinix for expanded connectivity and higher networking performance, security and scale to support its AI workloads.

Crusoe: Like Coreweave, Crusoe also started as a crypto mining company. Originally focused on clean energy mining, Crusoe has leaned hard into the AI workloads opportunity. In total, the Company has raised $852M across debt and equity at a $1.75B valuation from investors like Valor Equity Partners, Polychain, SVB, Bain Capital Ventures (who originally backed the crypto project), G2VP, Upper90 and a plethora of other firms. Crusoe has secured an initial commitment of $200 million for the purchase of GPUs from Upper90 for the continued scaling of Crusoe Cloud. Public estimates claim Crusoe generated more than $100M of revenue in 2022 and will at least 3X in 2023.

Two natural gas glares with a Crusoe modular data center, photo from Crusoe

The Company powers 100% of its new capacity via carbon free energy, leveraging emissions from natural gas that is otherwise burned during oil extraction in a process called flaring. The company operates over 100 of these gas-powered data centers in the oil-rich parts of North Dakota, Montana, Wyoming and Colorado. Its unclear how much of the Company’s revenue is GPUs for AI vs. crypto, but the company has stated it is profitable. Crusoe, like Lambda, is also working with Equinix Platform on its networking and data center operations.

Other GPU Clouds: Applied Digital is a notable GPU cloud provider, having recently announced Elite Partner Status in NVIDIA’s CSP network. Paperspace by DigitalOcean also has decent usage as a GPU cloud. There are a plethora of other smaller operations which we won’t go into, but the broader point is that data center infrastructure is no longer in the hands of just the Big 3.

The Financialization of the Data Center with PE joint ventures

In addition to the GPU providers entering the space, giant private equity firms are also emerging in a major way to the data center space. Blackstone and Digital Realty launched a $7B joint venture to develop 10 data centers across four campuses in Frankfurt, Paris, and Northern Virginia. Blackstone will acquire 80% ownership in the joint venture for about $700M of initial capital, while Digital Realty will own 20%. Blackstone also announced $8B of its flagship $68B property fund will be allocated to data centers with QTS Data Centers, which Blackstone acquired in 2021 for $10B including debt. The Company said data centers were the biggest contributor to its returns this year and its investment in QTS is now worth over $20B just two years later.

Its clear that there are a whole host of new entrants in the data center landscape — from the $5B raised by GPU providers like Coreweave, Lambda, Crusoe and more; to private equity firms like Blackstone launching joint ventures with data center operators like QTS and Digital Realty and a staggering $20B of investment. All these players are competing for AI training and inference workloads.

Data center colocation providers like Equinix and Digital Realty are poised to benefit from operational expertise in the physical data centers. They bring strategic expertise in managing the servers and networking equipment, as well as the physical spaces around the world for secure, reliable and high-speed connections.

What this means over time is AI workload costs will come down dramatically and we will see AI use cases unlocked in far more applications. For now, we are in the AI infrastructure supercycle period…