What does Palantir do?

From unconventional beginnings as a gov tech contractor to $80B+ AI leader, discussing how Palantir is bringing AI to production with enterprises and government

Palantir has evolved from its humble and unconventional beginnings, where it was hated on as government tech contractor to the richest valued company in the SaaS industry. Today, Palantir boasts an enterprise value-to-annual recurring revenue (EV/ARR) multiple of 32x and a market capitalization of $82 billion. Once criticized for its custom services with the government, Palantir is now productionizing AI in the most complex enterprise and government environments globally and is emerging as a leader in enabling huge organizations to centralize their data.

Founded in 2003 by Peter Thiel, Alex Karp, Nathan Gettings, Stephen Cohen, and Joe Lonsdale, Palantir was initially backed by Peter Thiel’s Founders Fund and by the CIA’s venture capital arm, In-Q-Tel. The company's original mission was to develop a platform that could assist intelligence agencies in counter-terrorism efforts by integrating and analyzing complex data sets. Today, Palantir is known for its robust data integration and analytics platforms, primarily Foundry and Gotham; its latest growth is coming from productionizing AI with its AI Platform. Its client base spans both government and commercial sectors, with notable customers including the U.S. Department of Defense, CIA, and major enterprises across industries like healthcare, energy, and finance.

While Palantir has achieved massive success, there’s not much proportional understanding about its products and what gave rise to the company. We attempt to break down what’s behind Palantir’s success.

From Engineers to Enterprise: How Palantir Scaled Beyond Services

For years, Palantir was perceived more as a services company than a traditional software firm, deploying teams of engineers to client sites to spend months tailoring its software—a process that resembled consulting more than scalable deployment. Adding to its mystique was Palantir’s unconventional approach to growth: the company famously claimed to have "no salespeople, only forward-deployed engineers." This unique strategy attracted technical founders who saw it as proof that a company could succeed without a traditional sales force. Venture capital firms remained dubious, while Palantir continued raising money from Founders Fund (and affiliated groups like 8VC) along with the CIA’s venture arm, In-Q-Tel.

As Palantir secured increasingly large contracts with both government and commercial clients, it became clear that its services-heavy model needed to evolve. However, this focus on services allowed the engineering org to shape its product around the needs of the most demanding, at scale deployments. The company built out robust data infrastructure, including its Foundry data platform, which allowed for more standardized deployments and dramatically reduced the need for custom services. Palantir essentially only focuses on huge deals, closing over 27 $10M+ deals in Q2 of this year. These large-scale agreements alongside its platform investments drove up gross margins to 81%, solidifying its position as a scalable software business. Today, Palantir has evolved from its forward deployed engineer model to an account-based sales strategy, leading Palantir’s expansion to commercial agreements from its roots in government.

Product: Foundry

Palantir Foundry says “it is not a data platform” but an operations platform designed to leverage your existing data platforms, analytics tools and governance paradigms into a unified data asset.

Foundry is designed to enhance and extend existing data infrastructure investments, such as data lakes and warehouses (Snowflake or DB, or even S3 or Azure), by integrating data and models into operational workflows without disrupting established systems. It synchronizes only the data needed for specific tasks, ensuring that original data sources remain intact. Foundry supports bidirectional data flows, allowing data generated within the platform to be automatically updated back to the enterprise systems. It also enforces robust governance through detailed tracking and granular access controls, making it adaptable to complex, evolving enterprise strategies while maintaining data integrity and compliance.

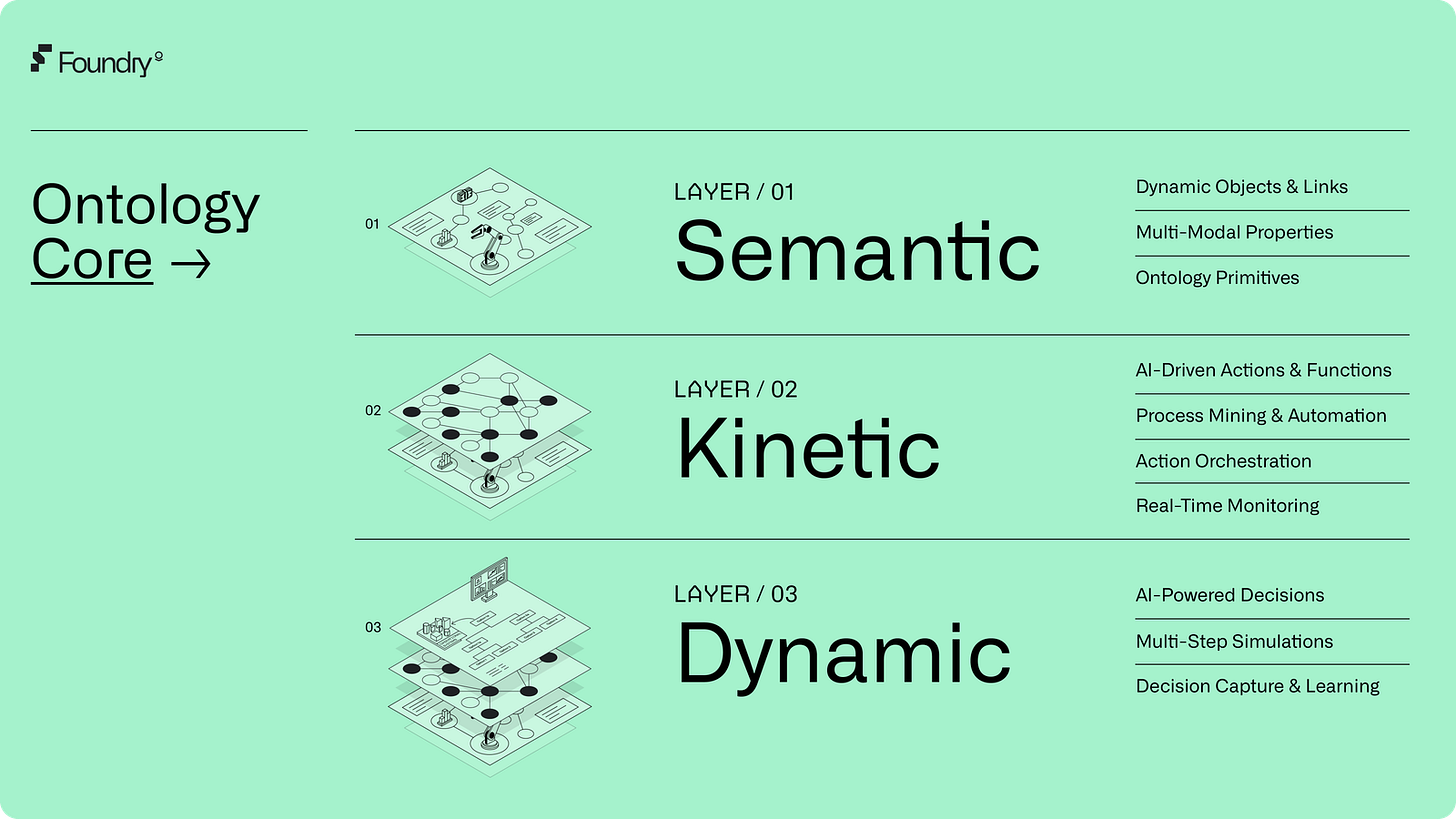

Its core strength lies in its Ontology system, which allows users to model their data into a shared framework that represents their business operations and entities. This system enables seamless collaboration and consistency across departments, ensuring that all data interactions are aligned with the organization’s objectives.

Large enterprises like Airbus, BP, and Morgan Stanley choose Foundry for its scalability, flexible deployment options, and comprehensive security features. It can be deployed on-premises, in the cloud, or in hybrid environments, making it suitable for industries with stringent data governance and compliance requirements. Foundry offers detailed role-based access controls, data lineage tracking, and automated synchronization with existing systems. Its Retention System enforces data retention policies, while native SSO integration streamlines secure access. These features, combined with end-to-end encryption and support for complex data workflows, make Foundry ideal for organizations that need both flexibility and robust data management. Its ability to integrate seamlessly with existing infrastructure investments further enhances its appeal to companies requiring a balance of customization, security, and control over their data.

Product: AIP

Palantir’s Artificial Intelligence Platform (AIP) offers a platform and workflow builder designed to create, deploy, and manage AI applications. Rather than integrating simple chat, AIP gives developers the ability to turn AI in your apps into Agents and Automations. Foundry and AIP go hand in hand, and are often deployed together. AIP enables the integration of LLMs into data pipelines with production-grade features like error handling, automatic retries, and guaranteed output schemas. Through the Workflow Builder, users can design AI apps and actions while leveraging the Ontology to ensure that AI logic aligns with the enterprise’s operational framework.

AIP’s development environment includes features for debugging AI logic, comparing model performance, and monitoring AI applications with customizable benchmarks, all of which are visualized through intuitive dashboards. The Ontology SDK further anchors software development in the business context, allowing developers to build AI applications directly from their preferred IDEs like VS Code. This structured, reusable framework helps enterprises rapidly scale AI deployment and manage the operational truth of their business through a shared, decision-centric model.

Key customers of Palantir’s AIP include organizations like the U.S. DoD, Merck, and IBM, using the platform for applications ranging from predictive maintenance and supply chain optimization to drug discovery and customer service. These use cases leverage AIP’s capabilities to integrate AI into complex workflows, enabling real-time decision-making and operational efficiency across diverse industries.

AIP is likely the #1 reason why Palantir’s stock is surging as an AI platform.

Product: Gotham

Palantir Gotham is a geospatial data and intelligence platform primarily used by government and defense agencies to integrate and analyze multimodal data from sources like sensors, satellites, and other surveillance systems. It excels at visualizing complex data in a geospatial context, enabling users to track and analyze movements, identify patterns, and respond to emerging threats in real-time. Gotham’s capabilities are useful in mission-critical operations such as military strategy, border security, and disaster response, providing a comprehensive view of operational environments.

Product: Apollo

Palantir Apollo is a comprehensive DevOps platform for managing software deployments across diverse environments, automating the continuous integration and delivery (CI/CD) process. It simplifies the deployment pipeline, enabling rapid feature delivery and stable performance across on-premises, cloud, and hybrid settings. Alternatives to Apollo include platforms like GitHub Actions, GitLab CI/CD, Jenkins, CircleCI, and AWS CodePipeline. These tools provide varying degrees of customization and integration support, helping organizations automate software delivery and streamline development processes while maintaining high reliability and speed.

Financial Performance

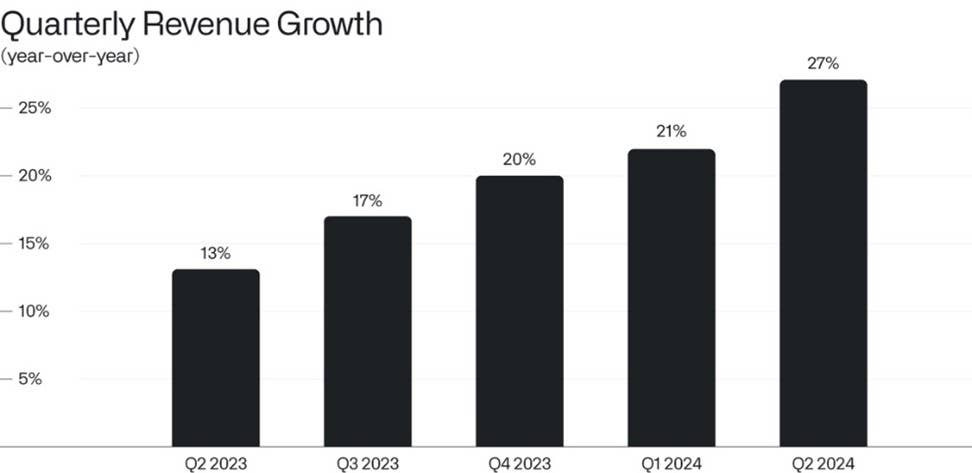

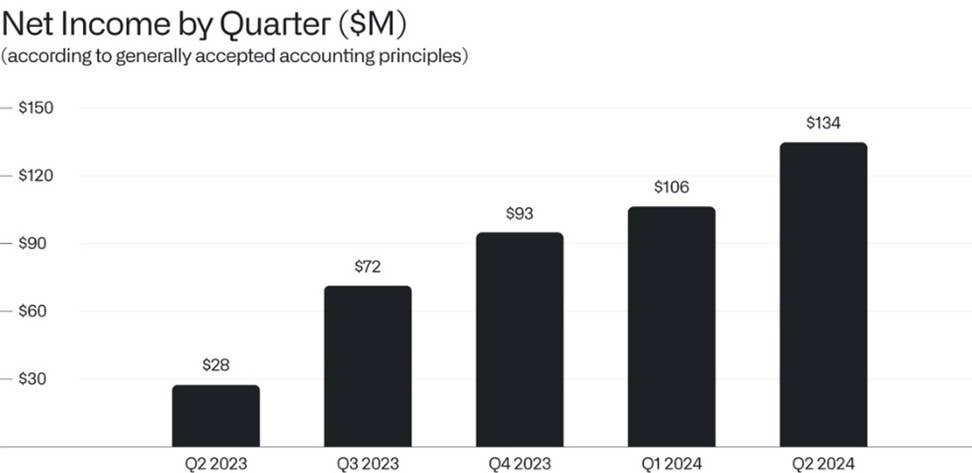

As PLTR 0.00%↑ approaches $3 billion in ARR, Palantir is growing at 27% year-over-year (accelerating over the past year) with 21% cash flow margins. The company is renowned for its operational efficiency, achieving a Rule of 40 score of 48% and securing 27 deals over $10 million in Q2 2024 alone. At IPO, its top 20 customers were 67% of revenue and over $25M each showing the nature of the huge deals the company wins. Its customer count is growing faster than revenue at 41% year-over-year as it expands to more commerical deals. Profitability is growing fastest, with annualized net income growing from $112M to $536M in the past year — up 378% year-over-year.

Its revenue mix is roughly balanced, with 55% coming from government contracts—75% of which are U.S. government-related—and 45% from commercial customers.

Business Overview: Government

For the first time in the company’s history, trailing twelve-month revenue from U.S. government contracts, including defense and intelligence agencies, exceeded $1 billion. Today, its annualized government revenue is over $1.5B marking a 23% increase year-over-year and an 11% growth quarter-over-quarter. U.S. government revenue contributed ~$1.1B of this. This growth reflects the U.S. government’s rapid adaptation to emerging technologies like LLMs, recognizing the transformative potential they bring to defense and intelligence operations. Key government agencies purchasing Palantir include the Department of Defense, various intelligence agencies like the CIA, and the Department of Homeland Security. These agencies utilize Palantir’s platforms for critical applications like counter-terrorism, military strategy, and border security.

Generated with GPT4, Palantir’s use in the government and intelligence agencies

If you are a startup founder, I highly recommend checking out Palantir’s FedStart program which helps software companies meet federal security and compliance requirements. Palantir FedStart allows software companies to run their products in Palantir’s secure, accredited environment without needing separate FedRAMP or IL5 certifications. By containerizing their software, companies can use FedStart to quickly deliver their solutions to government agencies, meeting key security requirements in just weeks. Fedstart allows software vendors to enter the government market. By simplifying this process, FedStart enables tech startups to compete for federal contracts that were traditionally challenging to access.

Business Overview: Commercial

Palantir’s most significant growth is in its U.S. commercial business, driven by the rising demand for AI in production and the capabilities of its Foundry platform. In Q2 2024, U.S. commercial revenue grew 55% year-over-year, reaching $636M annualized. The surge is fueled by Fortune 2000 companies in financial services, healthcare, and traditional industries seeking to leverage AI at scale. Foundry’s data integration and the AI in production platform’s ability to operationalize AI across enterprises are key drivers, enabling companies to implement AI effectively and drive business outcomes.

Notable stats on its Commercial business include:

U.S. commercial revenue: $636M annualized, up 55% year-over-year.

International commercial revenue: $592M annualized, up 16% year-over-year

Deals closed: 96 deals over $1M, 33 deals over $5M, 27 deals over $10M.

Average deal size: $2.2 million per customer.

U.S. commercial customer growth: +83% year-over-year, +13% quarter-over-quarter, reaching 295 customers.

Conclusion

Palantir has emerged as a leader in productizing AI for the largest enterprises and governments by integrating advanced AI capabilities with robust security and data governance. Today, it boasts a staggering $83B market capitalization 20 years after its founding. For over a decade, it was underestimated as what was thought to be a services company.

Foundry and AIP are the company’s major growth engines, driving adoption through their ability to scale AI operations securely and efficiently. Key to this success is Palantir’s focus on open data architecture, allowing seamless integration with existing systems and ability to adapt, while maintaining strict data governance and compliance standards. This combination makes Palantir uniquely positioned to support complex, mission-critical operations across sectors.

Great explanation!

Palantir market cap and overall value add is crazy. Many in my network think it as next Amazon or Nvidia from stock pov

Bill Maher talked to Alex on his show and Bill did not understand a word lol