Why Google Wants to Acquire Wiz

Strategic importance and challenges in Google's potential $23B acquisition of Wiz

Google is reportedly in advanced talks to acquire Wiz for $23B, which would be Google’s biggest acquisition ever. Founded only 52 months ago in March 2020 by the former team behind Adallom (acquired by Microsoft for $310M), Wiz has emerged as the newest cloud security platform — a rare breed as a platform versus a point solution. At a $23B purchase price, there are only 4 pureplay cybersecurity companies at greater scale — Palo Alto Networks ($110B), Crowdstrike ($91B), Fortinet ($45B) and Zscaler ($31B). Microsoft’s security revenue is approximately as large as these next 5 vendors combined, at over $20B.

Google’s Motivation: Run the Microsoft playbook?

So why is Google interested? It’s no secret every cloud vendor is playing catch up with Microsoft, who is gaining cloud market share thanks to enterprise robustness, security, and AI products. Microsoft has been the most successful security vendor globally, with Evercore estimating its cyber unit will produce $37B of sales by 2025 and accounting for 14% of its overall revenue. Microsoft stated its security business did over $20B of revenue in 2022 and is growing more than 30%.

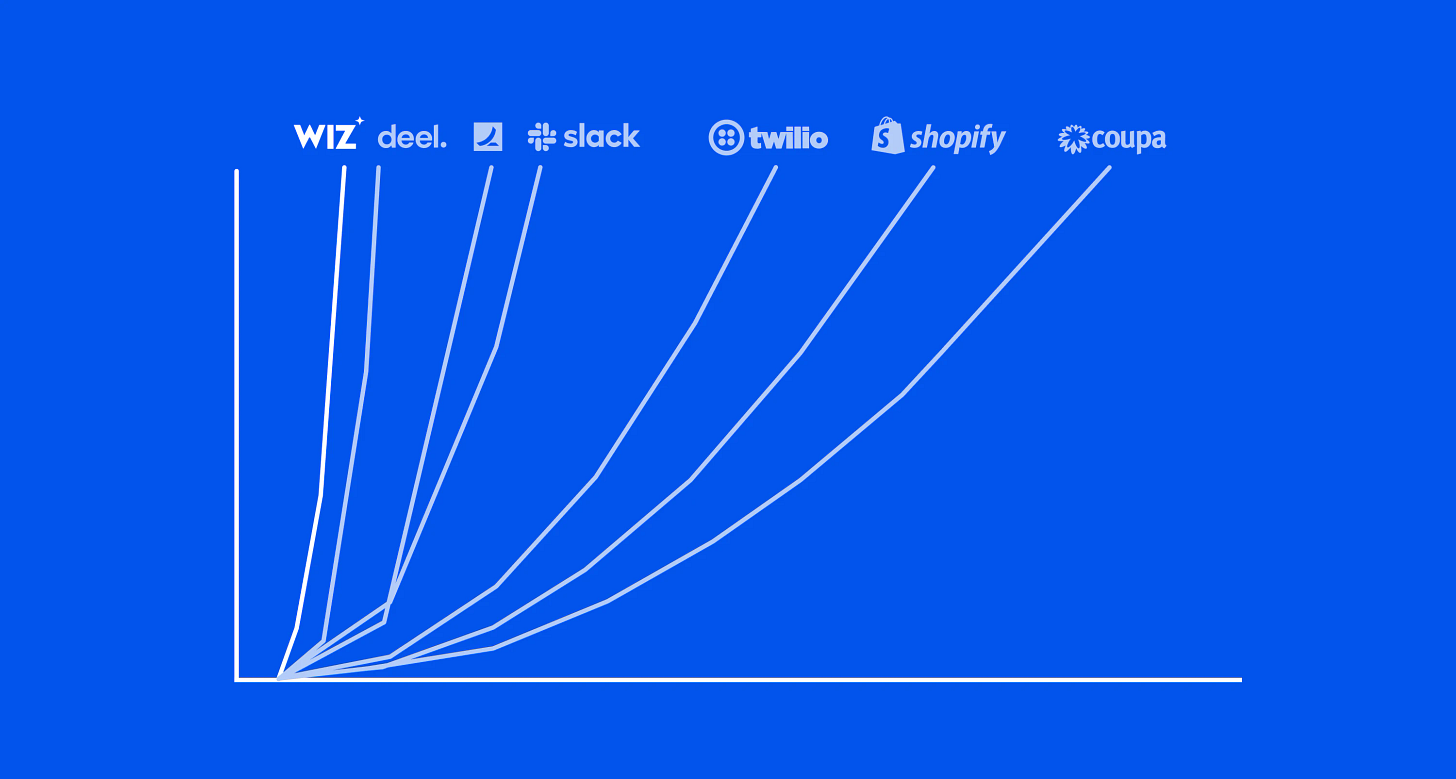

The founders of Wiz, including CEO Assaf Rappaport, CTO Ami Luttwak, VP Product Yinon Costica, hail from Adallom and then Microsoft. The founders of Wiz have been working on cloud security since 2015 with Adallom, bringing unparalleled practitioner expertise. Post-acquisition of Adallom in 2015, the Wiz founders integrated into Adallom into Microsoft. Importantly, Microsoft is where they absorbed the Microsoft enterprise sales playbook. It’s no coincidence that Wiz had so much success selling to enterprises and the Microsoft install base — having 40% of F100s as customers in the first 5 years of operations is unheard of! These strategic relationships and their deep understanding of enterprise sales positioned Wiz to become the fastest company to $100M of ARR in just 18 months.

Security is core to Google's cloud products, encompassing both applications like GSuite and its cloud offering GCP. However, Google has been playing catch-up with Microsoft in the security domain. Google made a big step to bolster its security business in 2022 acquiring Mandiant for $5.6B, primarily focusing on security operations and incident response. Wiz, specializing in identifying risks across major cloud platforms like AWS, Microsoft Azure, and Google Cloud, presents a significant strategic acquisition for Google.

From Google’s perspective, acquiring Wiz not only enhances its security offerings and doubles down on its efforts with Mandiant, but also helps bridge the gap with Microsoft's advanced security infrastructure. Wiz brings deep internal knowledge from Microsoft, where its founders previously worked, and combines this with founder practitioner expertise to offer comprehensive cloud security solutions. This acquisition mirrors the Microsoft playbook of leveraging strong customer relationships and strategic technology integration to bolster enterprise sales.

Strategic Benefits for Google:

Competitive Positioning: This acquisition positions Google to better compete with Microsoft in cloud deals where security is a top priority (i.e. the $10B DoD deal) as well as offer direct products competing against cybersecurity leaders like Palo Alto Networks, Zscaler and CrowdStrike.

Improved Security Capabilities: Wiz’s technology would complement Google’s existing security tools, providing a more integrated security solution for customers. By integrating Wiz’s advanced anomaly detection and response capabilities, Google can offer a more robust security solution, enabling it to better compete with Microsoft's established enterprise security offerings and secure a stronger foothold in the competitive cloud market (wiz.io) (Security Week).

Resource Optimization: Google’s substantial cash reserves and profitability make the $23 billion acquisition feasible without immediate financial strain. Additionally, Google’s existing infrastructure and technological expertise can help optimize Wiz’s operations and product development.

Customer Base: Wiz’s customer base includes over 40% of the Fortune 100 companies, many of which are already on GCP and even more on Azure. Wiz’s ambitious target of reaching $1 billion in sales by 2025 would make the purchase price in-line with Crowdstrike’s multiple.

Wiz’s Perspective

For Wiz, the acquisition offer by Google sounds compelling:

Immediate, Unparalleled Financial Gain: Wiz is in elite company, with only Palo Alto Networks, Crowdstrike, Zscaler and Fortinet as larger public Cybersecurity vendors. At $23B, the acquisition would provide immediate liquidity for employees and investors, avoiding the complexities and risks associated with an IPO and offering nearly the same upside.

Each of Wiz’s 3 founders would net an estimated $2B from 10% positions and presumably would have further upside within Google for sales targets.

Scalability: Google’s financial and technological resources can help Wiz scale more efficiently, addressing economic pressures such as improving gross margins and reducing cloud costs.

Product Expansion: Google’s backing can support Wiz’s efforts to expand its product offerings, including its new real-time, agent-based security solutions. The company is transitioning from agentless to agent-based cloud security products to detect real-time threats, necessitating substantial investment.

Despite a recent $1 billion funding round at $12B and an impressive annual recurring revenue (ARR) of ~$500M, Wiz faces the challenge of sustaining growth in a highly competitive cybersecurity market that is moving towards platforms (Calcalistech). AWS has closely partnered with Crowdstrike. Microsoft is the largest security vendor globally. Wiz could do the same with Google.

Challenges

There are several challenges that Google and Wiz must navigate to ensure the success of this acquisition:

Anti-trust: It’s no secret huge M&A deals like Google/Wiz are facing intense scrutiny. Adobe’s $20B Figma acquisition was blocked by regulators. Independent security vendors like Palo Alto Networks, Crowdstrike, Zscaler and others likely will dispute this acquisition; Microsoft and Amazon may as well.

Customer Migration: Wiz’s platform primarily secures workloads on AWS and Azure, which could lead to customer migration issues if Google acquires Wiz. Wiz could end up losing many of its customers on Azure and AWS, as it loses its independence.

Cultural Integration: Integrating Wiz into Google’s corporate culture could be challenging. Wiz’s fast-paced environment might clash with Google’s big company practices, risking the departure of key talent.

Sales Strategy: Google must refine its enterprise product sales strategy to effectively market Wiz’s solutions. Historically, Google has faced challenges in selling enterprise products, which requires a different approach compared to consumer products.

Conclusion

The $23B acquisition offer for Wiz by Google represents a key step in boosting Google's cloud security and is a bold move to compete with Microsoft. Integrating Wiz’s technology and expertise gained directly at Microsoft from Adallom enables Google better compete with Microsoft and other top cybersecurity firms. The megadeal faces challenges, including regulatory scrutiny, potential customer shifts, and cultural integration. If handled well, this acquisition could enhance Google's cloud security offerings and strengthen its position in the market.