Why Crypto Miners Won the AI Data Center

How crypto miners like CoreWeave and Crusoe became the best AI data center operators

Many of the most important AI data center operators of this era—CoreWeave ($25B), Crusoe ($3B), Core Scientific ($2.5B) ( CORZ 0.00%↑ ) and Applied Digital ($1.2B) (APLD 0.00%↑ ) —weren’t born in Silicon Valley or Northern Virginia. They were forged in the boom-and-bust cycles of cryptocurrency mining. CoreWeave, for example, began as Atlantic Crypto, a small 2017-era Ethereum mining operation using off-the-shelf Nvidia GPUs to mine ETH at scale. The founding thesis was simple and capital-efficient: deploy GPU hardware in remote areas with cheap electricity to extract decentralized value. That operational DNA—energy arbitrage, GPU provisioning, and infrastructure frugality—became the ideal playbook for today’s AI infrastructure wave.

The Traditional Model: Location, Location, Location

Source: Data Center Map

The traditional data center industry in the U.S. was built around proximity to people and networks. Most facilities were clustered in population-dense regions like the Northeast Corridor—especially Northern Virginia, where Ashburn alone hosts over 250 data centers and handles over 25% of U.S. traffic. In fact, Ashburn is known as “Data Center Alley” These locations were optimized for latency-sensitive workloads like cloud, SaaS, and mobile apps, prioritizing fiber interconnects and enterprise adjacency over raw power or physical scale. Operators like Equinix and Digital Realty built premium facilities near end users to support high bandwidth requirements.

Source: S&P Global

The 2015 Shift: The Rise of the Energy-First Data Center with Cryptocurrency Mining

Around 2015, crypto mining exploded. For the first time, a new kind of data center emerged—built not for people, but for algorithms. Crypto miners didn’t care about being near a user — or location at all frankly. They cared about:

Cheap, abundant electricity

Cheap/remote and large land lots to host racks of Nvidia GPUs

Minimal human intervention

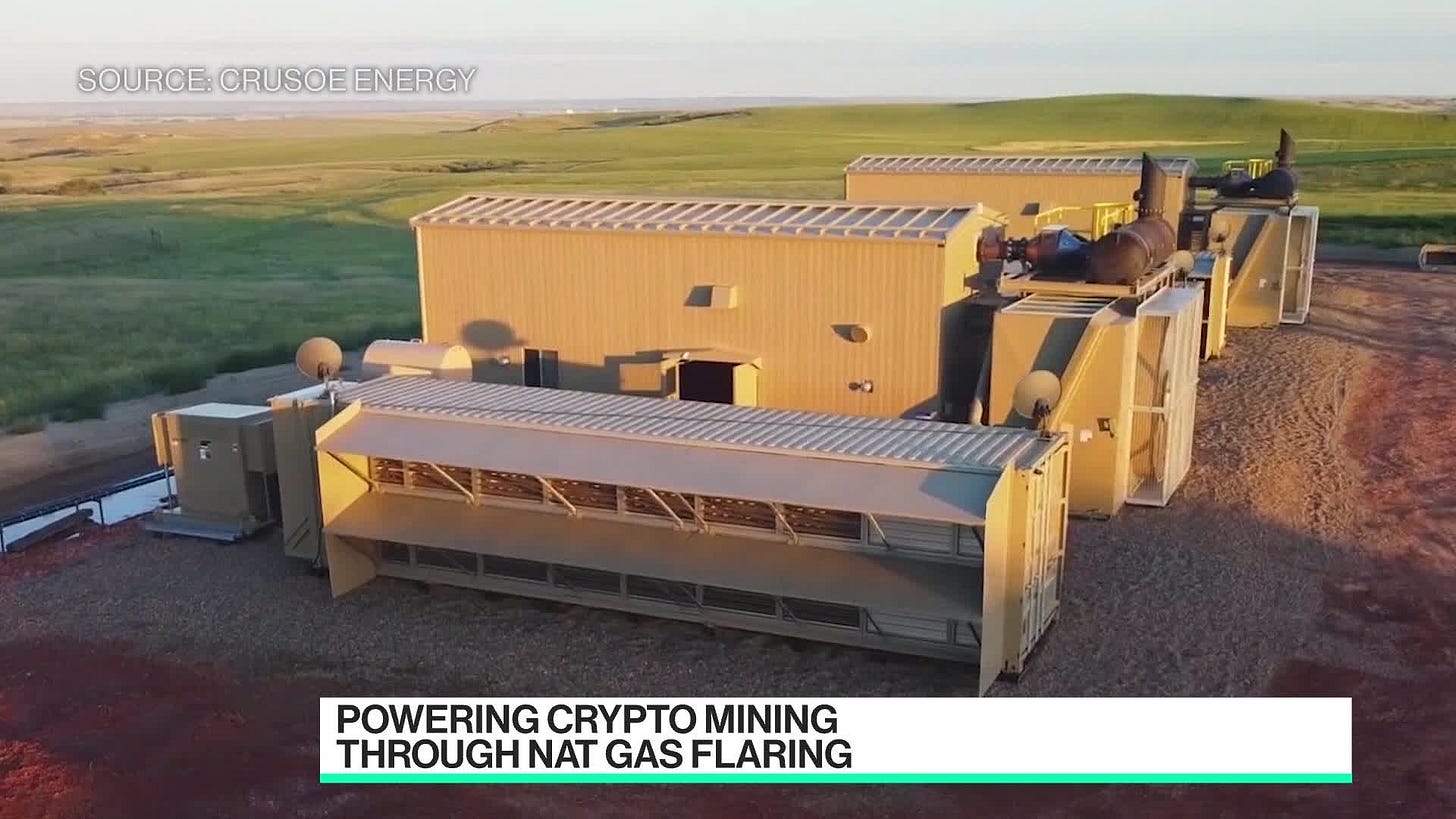

It didn’t matter whether a Bitcoin was mined in North Dakota, China or Iceland. The physical location was irrelevant as long as the power was cheap. Companies like CoreWeave mined Ethereum using consumer-grade Nvidia GPUs; Crusoe converted flared gas from oil fields into compute, sourcing cheap excess electricity; Lambda Labs sold GPU boxes to miners before pivoting to the cloud.

Source: Meet the Company Mining Bitcoin Using the Flare Gas from Oil Drilling - and Drawing Investment from Coinbase and the Winklevii [Link]

2022–Present: AI Workloads Look a Lot Like Crypto

By 2022, the data centers built by crypto miners became incredibly valuable. AI training and inference workloads—driven by massive foundation models—demanded the same things that crypto mining data centers focused on to maximize profits:

Huge amounts of cheap electricity

Physical real estate and space to scale horizontally

High-performance Nvidia GPUs (H100s, A100s) to mining and now AI

Unlike cloud or SaaS workloads, AI compute is batchy, power-intensive, and capital-heavy. The new bottlenecks were no longer fiber routes or real estate density—they were power, GPUs, and cash. As AI training spend exploded (OpenAI’s cluster spend now exceeds $2B/year), the mining-born companies were already optimized for this. They had huge capacity before traditional clouds could build these AI data centers.

Source: Texas Miner pivots from Crypto to AI [link]

From Flare Gas to Foundation Models

Crusoe’s pivot is emblematic. In April 2024, Crusoe sold off its Bitcoin mining business to NYDIG to go all-in on AI infrastructure, building a 1.2 GW data center campus in Texas. This isn’t just a rebrand. It’s a recognition that AI workloads are now more profitable than crypto and better aligned with long-term capital markets.

“Crusoe’s vertically integrated model was built for a world of compute scarcity.” – Crusoe Press Release, April 2024

Source: Bloomberg, Powering Crypto Mining through nat gas flaring

Conclusion

In this new era, the crypto miners (CoreWeave, Crusoe, Core Scientific, and Applied Digital) didn’t just pivot—they already won. They owned the land, the energy contracts, the GPUs, and the capital mindset to build at scale. They had (inadvertently) optimized their data center footprint for exactly what AI workloads needed:

Cheap electricity

Huge physical footprints

NVIDIA hardware

This data center archetype has a fundamentally different archetype than the data centers for internet/mobile/cloud: near population centers, with higher energy cost and smaller physical footprints.

Hm…CoreWeave isn’t a land baron; it’s a GPU middleman. Its margins are sandwiched between Nvidia (upstream) and landlords/utilities (downstream). Unless it locks in long-term control of power and property, it’s just timing an arbitrage window before vertical integration crushes it.