Databricks: Firing on all cylinders in 2024 after its Data+AI Summit

The latest with Databricks: new AI and Data Infrastructure product launches, and key takeaways from 2024 Data + AI Summit

Databricks is accelerating — growing faster at $2.4 billion ARR (~65%) than last year at $1.5 billion ARR (50%). With ~140% net retention, Databricks would best any public software company on this metric — as it would on revenue growth. More than 50% of companies use 6+ products. This accelerated financial trajectory is credence to Databricks' strong market position in data infra and AI. When you dig deeper, the revenue growth is proof of its ability to launch new products for AI/ML. New products in particular have been huge sources of growth, with its data warehouse revenue achieving >100% growth, now contributing $400M annually. This rapid expansion not only underscores the increasing demand for AI infrastructure but also positions Databricks as a leading player in the AI software market, valued at over $50B in private markets.

Ali Ghodsi, co-founder and CEO of Databricks, at a press conference during the Databricks Data and AI Summit in San Francisco on June 12, 2024.

Key Announcements from the Data + AI Summit

At the recent Data + AI Summit, Databricks highlighted its latest developments and strategies. The event attracted 60,000 attendees, including 16,000 in person, demonstrating the company's significant reach and influence. During the keynote, Ali (CEO and co-founder) discussed several key initiatives:

Tabular Acquisition [read our piece on the Tabular acquisition here]: Databricks acquired Tabular, created by the original developers of Apache Iceberg, to streamline storage options for customers. With 92% of customer data already on Delta Lake and 8% on Apache Iceberg, this acquisition helps Databricks simplify and control the storage format landscape.

AI Integration: Databricks has integrated AI throughout its platform to increase its own performance. Databricks claims its data warehouse product is 60% cheaper and faster than competitive offerings.

BI/SQL Compatibility: The Databricks platform is compatible with various BI & SQL Analytics such as Tableau and Looker, making it easier for customers to use their preferred software within the Databricks ecosystem.

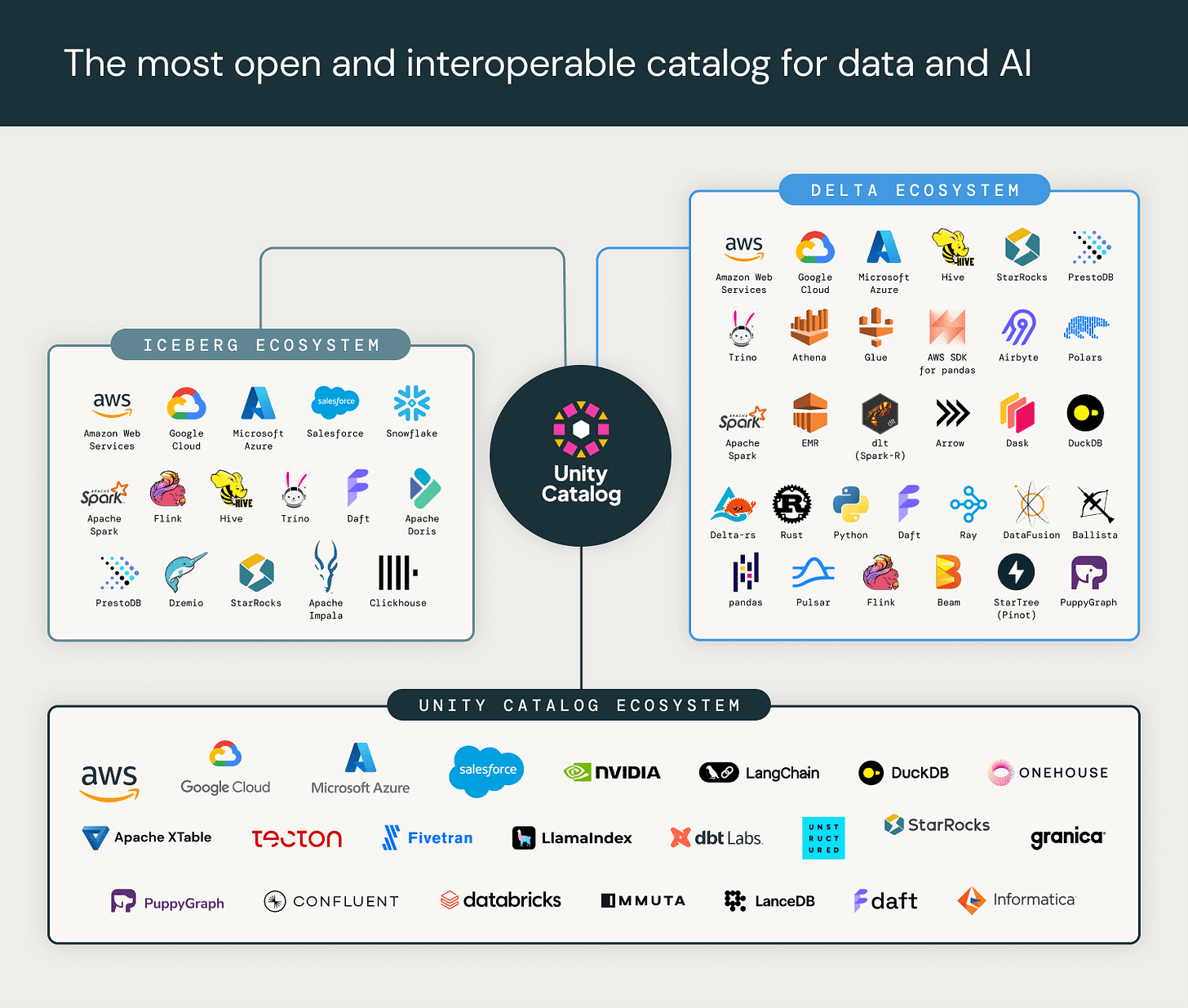

Open-Source Unity Catalog: Databricks announced that Unity Catalog will be open-sourced, allowing for greater transparency and community collaboration. This move aims to enhance data governance and security by leveraging community-driven improvements and innovations. Databricks' Unity Catalog emphasizes open-source, governance, and security, helping the company lead in this area.

LakeFlow Connect: Simple ingestion connectors for databases and enterprise apps

Recent Product Launches

Databricks has introduced several new products in recent years that are expanding the surface area of data and AI use cases DB addresses within the enterprise. Databricks gave updates on these recent product launches:

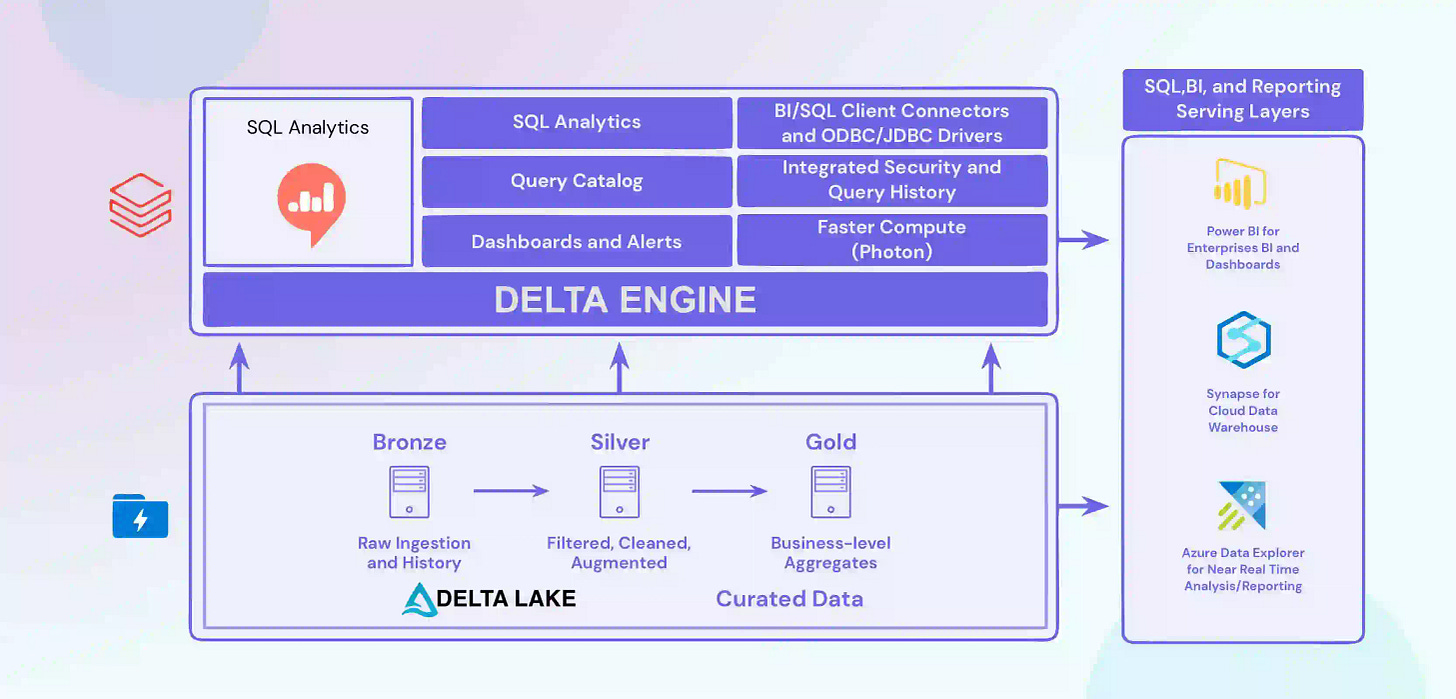

Delta Lake: Databricks transitioned from being known for Spark to Delta Lake, offering a data lakehouse solution that merges data lakes and data warehouses.

Enterprise LLMs: The company has expanded its AI capabilities with the introduction of enterprise Large Language Models (LLMs), providing advanced AI-driven insights. The success Databricks is seeing here is a result of its $1B acquisition of MosaicML.

Serverless Computing: The serverless computing feature, developed over several years, simplifies data management by removing the need for managing data layout, cluster tuning, and capacity planning.

SQL and Data Warehousing: Databricks SQL, available for 2.5 years, has grown to $400 million in annual recurring revenue. It offers fast startup times and integrates well with existing analytic tools, providing competitive price and performance.

Financial Highlights

Databricks' annualized sales through July, covering the first six months of fiscal 2025, are expected to rise by 60% compared to the previous year, according to CFO Dave Conte. This impressive growth stands in stark contrast to other software industry players like Okta, Salesforce, and UiPath, which have struggled with economic volatility. Despite these broader market challenges, Databricks continues to show robust performance and a strong upward trajectory.

Key Financial Metrics:

Annualized Sales Growth: 60% increase for the first six months of fiscal 2025.

January Quarter Transactions: 221 transactions exceeding $1 million.

Net Revenue Retention: Over 140% for the 2024 fiscal year.

Gross Margin: 80%.

Data warehousing: >$400M of revenue and >100% growth for its Databricks SQL data warehouse product, with over 7,000 customers

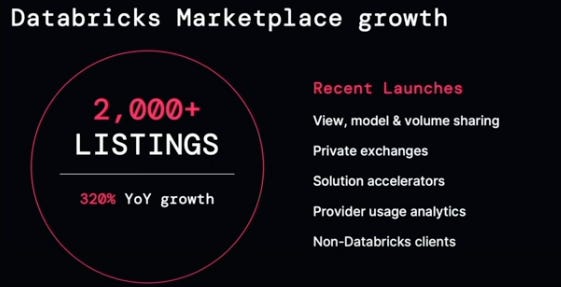

Evidence to the fact that Databricks is becoming a platform, over 2,000 third-party application or infrastructure developers listed on the Databricks Marketplace — this is up >320% year-over-year!

Databricks is one of the prominent venture-backed software makers on the path to an IPO, alongside notable companies like Canva, Figma, and Stripe.

Conclusion: The Future of AI at Databricks

The AI landscape is changing quickly, and companies are increasingly focused on using data and AI for a competitive advantage. With 85% of AI use cases still not in production, Databricks is well-placed to meet the rising demand for AI infrastructure and solutions. Most notably, Databricks’ ability to launch or acquire new products like its warehouse and MosaicML suite are highly impressive, expanding its reach from data infrastructure to AI/LLM use cases.

Nailed it!!