The Semiconductor Landscape in 2023: An Update on the "Silicon" of Silicon Valley and the role of Semis in AI

Profiling the 20 largest semiconductor companies and key industry trends in the data center, with an emphasis on AI initiatives

In this issue of Data Gravity, we delve into the industry that quite literally embedded its name in the heart of innovation: Silicon Valley.

(Pictured: The Fairchild 8, who left the lab of Nobel Prize winner William Shockey to form Silicon Valley's first start-up, Fairchild Semiconductor. From left to right: Gordon Moore, C. Sheldon Roberts, Eugene Kleiner, Robert Noyce, Victor Grinich, Julius Blank, Jean Hoerni and Jay Last. 1960)

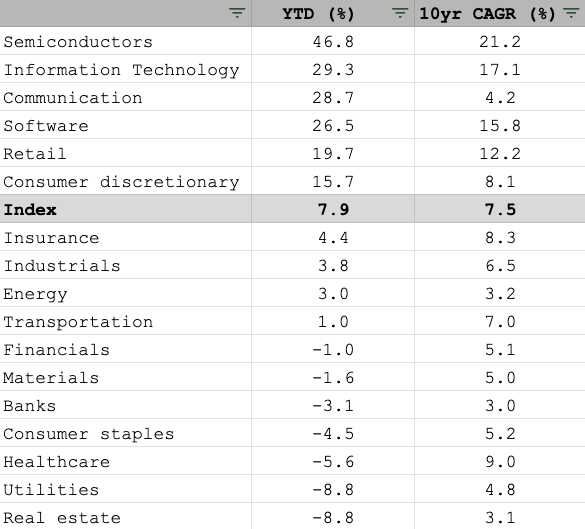

Once the forefront of the global tech scene, the semiconductor industry has somewhat receded from the limelight, overshadowed by the software giants it helped to spawn. With the rise of cloud software, the role of semiconductors has become underappreciated over the past decade, especially in the startup ecosystem. Perhaps surprisingly, public semiconductor companies have significantly outperformed the broader information technology sector in 2023 and over a 10 year CAGR basis per the MSCI indices. The MSCI Global Semiconductor Index has monstruous market capitalization of $5.1T, rivaling the software ecosystem. With AI and the shift to GPUs, Semiconductors are once again in the limelight

Yet, the influence of semiconductors remains pivotal, albeit less understood. This edition is crafted to demystify this sector, introducing you to the key players and industry trends of 2023. We'll explore how the rise of artificial intelligence, advancements in GPU technology, and innovative chip design are shaping the future of tech, offering vital insights for savvy investors looking to stay ahead in the dynamic world of venture capital.

Geographic Trends

There are noticeable patterns of semiconductor expertise across different geographical areas:

The U.S. 🇺🇸 is known for its strong presence in fabless semiconductor companies, which design and sell hardware devices and semiconductor chips but outsource the fabrication (manufacturing) of the chips to specialized firms, known as foundries. Companies like NVIDIA, Qualcomm, and AMD are prime examples of fabless companies. The U.S. also has significant players in semiconductor equipment and materials, such as Applied Materials and Lam Research.

The Netherlands 🇳🇱 hosts ASML, the maker of high technology essential equipment for semiconductor manufacturing, particularly in the field of photolithography. It also hosts NXP which just missed the cutoff for the list.

Asia (Taiwan 🇹🇼 , South Korea 🇰🇷 , and Japan 🇯🇵 ) is prominent in the foundry and manufacturing segment of the semiconductor industry. TSMC (Taiwan) and Samsung Electronics (South Korea) are the world's leading semiconductor foundries, handling the manufacturing for many fabless companies. SK Hynix (South Korea) and Tokyo Electron (Japan) are also key players in manufacturing and semiconductor equipment.

The 20 largest semiconductor companies globally, as ranked by market capitalization, are as follows:

NVIDIA - $1.2 Trillion 🇺🇸 — NVDA 0.00%↑

Broadcom - $510 Billion 🇺🇸 — AVGO 0.00%↑

TSMC - $507 Billion 🇹🇼 — TSM 0.00%↑

Samsung Electronics - $360 Billion 🇰🇷 (note: this is aggregated and its semiconductor unit would likely fall in the bottom half of this list)

ASML - $272 Billion 🇳🇱 — ASML 0.00%↑

AMD - $197 Billion 🇺🇸 — AMD 0.00%↑

Intel - $185 Billion 🇺🇸 — INTC 0.00%↑

QUALCOMM - $142 Billion 🇺🇸 — QCOM 0.00%↑

Texas Instruments - $139 Billion 🇺🇸 — TXN 0.00%↑

Applied Materials - $125 Billion 🇺🇸 — AMAT 0.00%↑

Lam Research - $94 Billion 🇺🇸 — LRCX 0.00%↑

Analog Devices - $91 Billion 🇺🇸 — ADI 0.00%↑

Micron Technology - $84 Billion 🇺🇸 — MU 0.00%↑

Synopsys - $82 Billion 🇺🇸 — SNPS 0.00%↑

KLA Corporation - $75 Billion 🇺🇸 — KLAC 0.00%↑

Cadence Design Systems — $74 Billion 🇺🇸 — CDNS 0.00%↑

SK Hynix - $71 Billion 🇹🇼

Arm Holdings - $66 Billion 🇬🇧 — ARM 0.00%↑

Arista Networks - $66 Billion 🇺🇸 — ANET 0.00%↑

Marvell Technology Group $50 Billion 🇺🇸 — MRVL 0.00%↑

While not pureplay semiconductor companies engaged in manufacturing, Synopsys (SNPS 0.00%↑) and Cadence Design Systems (CDNS 0.00%↑ ) are very much worth studying as well. With market capitalizations of $84 Billion and $73 Billion respectively, Synopsys and Cadence are juggernauts of the chip design, verification, IP management and manufacturing software for nearly the whole industry. The two have some of the most powerful moats in all of software and represent a duopoly of fierce competition. Arista Networks (ANET 0.00%↑) is also worth highlighting at a market capitalization of $68 Bilion. While not a pureplay semiconductor company, Arista specializes in high-performance networking solutions and software-defined networking products with network switches and software for large data center and cloud computing environments that integrate with semiconductor technology.

This list reflects the global geographical presence of leading companies in the semiconductor industry, but also the underappreciated dominance of the the United States with 75% or 15 of the top 20 companies. Taiwan hosts TSMC and SK Hynix in foundries, while the Netherlands is #1 in Europe with ASML and NXP Semiconductors (which comes in at #21). Korea hosts Samsung which blurs the lines, while Japan hosts Tokyo Electron. Perhaps surprising are no public Chinese companies on the list. In any case, it is very important the US maintains its leadership in this industry and that Taiwan remains independent as TSMC remains a single chokepoint in many ways for the industry.

Of course, the major FAANG companies also boast sizable internal semiconductor teams. These teams often partner with companies like Broadcom to codevelop chips that are often used behind the scenes at the big cloud providers like AWS, Azure and GCP. You can read more about Google’s TPU project with Broadcom here at SemiAnalysis.

Summaries of Key Players

Below we cover 15 of the key players by market capitalization, with an emphasis on the semiconductor companies with the strongest AI tailwinds (and highlighting a few players with negative AI tailwinds). Unsurprisingly, the US is by far the leader in AI-driven chip design — though you will see many immigrant CEOs from places like Taiwan and India driving leadership in the industry!

1. Nvidia

Headquarters: Santa Clara, CA

Year Founded: 1993 — not very long ago!

Management:

Founders: Jensen Huang (CEO and President), Curtis Priem, Chris Malachowsky

Bill Daly, Chief Scientist

Enterprise Value: $1.2T

1Y Returns: +206%

5Y Returns: +1,070%

Annualized Revenue: $72.4B

Growth: 206% YoY

Gross Margin: 74%

Annualized EBITDA: $41.7B, 56% margin

Headcount: 26,196

Products: GPUs, networking, AI enterprise software. See our coverage of Nvidia’s Q3 2024 Earnings report for more details.

AI Tailwinds: Exceptionally high as Nvidia’s GPUs are the critical compute for AI workloads from foundation models across inference and training. Nvidia’s dominance in AI is wildly underappreciated and the company is expanding into more software offerings with CUDA, networking and enterprise AI services.

What’s notable?: Pioneering transformation of the data center with its GPUs and networking offerings. We will do more follow up pieces on Nvidia’s business.

Investor Presentation: see here

2. Broadcom

Headquarters: San Jose, CA

Year Founded: 1961

Management:

Founders: Henry Samueli who is still Chairman

Hock Tan serves as CEO and president

Enterprise Value: $516B

1Y Returns: +82%

5Y Returns: +299%

Annualized Revenue: $35.6B split across 78% semiconductor solutions and 22% infrastructure software

Growth: +12% YoY, 21% 5 year CAGR

Gross Margin: 68%

Annualized EBITDA: $18.8B, 53% margin

Headcount: ~24,812 per LinkedIn

Products: Wide range of products across both semiconductors and infrastructure software serving markets such as data centers, networking, broadband, wireless, storage, industrial, etc.

AI Tailwinds: High, such as working with Google on TPU chips detailed here. Driving innovations in networking and the data center.

What’s notable?: Heavy use of M&A to drive growth, particularly in Broadcom’s expansion from semiconductors into infrastructure software

Acquired Brocade, a network gear maker, for $5.5B in cash in Nov 2016 to expand fibre channel and storage businesses

Acquired CA Technologies, a long-time giant in software for mainframe computers that expanded into cloud computing, for $18.9B in Nov 2018 to expand Broadcom’s presence in infrastructure software

Acquired Symantec’s Enterprise Security Business for $10.7B in cash in November 2019 to expand into software for corporate infrastructure

Acquired virtualization and cloud computing company VMWare for $69B in cash and stock — one of the largest deals in software history and faced intense regulatory scrutiny

Investor Presentation: see here

3. TSMC

Headquarters: Hsinchu, Taiwan

Year Founded: 1987

Management:

Founders: Morris Chang, who once worked at Texas Instruments — if only we were able to keep him in the US!

C. C. Wei (CEO)

Enterprise Value: $469B

1Y Returns: +23.5%

5Y Returns: +160%

Annualized Revenue: $69.2B

Growth: +5% YoY (jumps around with cyclicality of industry, 25% 5 year CAGR)

Gross Margin: 59%

Annualized EBITDA: $28.8B, 41% margin

Headcount: 73,090

Products: Manufactures a wide range of products for various applications such as Apple iPhones and Macs, to Nvidia semiconductors and more.

AI Tailwinds: Medium as TSM is effectively an index on the entirety of the semiconductor industry as the dominant foundry. The company manufactures chips for many of the largest players like Nvidia, Broadcom and more.

What’s notable?: TSMC is the world's first dedicated semiconductor foundry and serving nearly the entire industry (532 customers in 2022) with a diverse product portfolio (12,698 products in 2022).

Investor Presentation: see here

4. Samsung

Headquarters: South Korea

Year Founded: 1969

Management:

Founders: Lee Byung-chul

Lee Jae-yong (executive chairman)

Han-Jo Kim (chairman of the board and independent director)

Jong-Hee Han (vice chairman and CEO (DX))

Kye-Hyun Kyung (president and CEO (DS))

Enterprise Value: $360B

1Y Returns: +20%

5Y Returns: +74%

Annualized Revenue: $199B

Growth: -19% YoY

Gross Margin: 31%

Annualized EBITDA: $9.6B, ~5% margin

Headcount: 266,673

Products: Memory chips (DRAM, NAND), System-on-chips (SoCs) for smartphones and other devices, image sensors for cameras, and foundry services for design and production of integrated circuits

AI Tailwinds: Low, as the company is losing out to TSMC on cutting edge AI chip manufacturing and isn’t exposed to the top fabless industry players

What’s notable?: Samsung is the #2 foundry after TSMC and serves a variety of key industry players in the enterprise data center. Some say Samsung is losing its grip on the semiconductor manufacturing space.

Investor Presentation: see here

5. ASML

Headquarters: Veldhoven, Netherlands

Year Founded: 1984

Management:

Founders: Originally started as a joint venture between Philips and Advanced Semiconductor Materials International (ASMI)

Peter Wennink (CEO) and Gerard Kleisterlee (Chariman)

Enterprise Value: $280B, making it the most highly valued European technology company

1Y Returns: +17%

5Y Returns: +295%

Annualized Revenue: $29.2B

Growth: 16% YoY

Gross Margin: 52%

Annualized EBITDA: $10.4B, 35% margin

Headcount: 39,086

Products: ASML specializes in the development and manufacturing of photolithography machines used in the production of computer chips, where it has a practical monopoly due to the complexity of design

AI Tailwinds: Medium to High, as ASML is the sole supplier of extreme ultraviolet lithography (EUV) photolithography machines required for manufacturing the most advanced chips

What’s notable?: ASML’s machines are priced at approximately $150 million each — a truly staggering number showing the sheer complexity of their work. ASML primarily serves three major customers — TSMC, Samsung and Intel.

Investor Presentation: see here

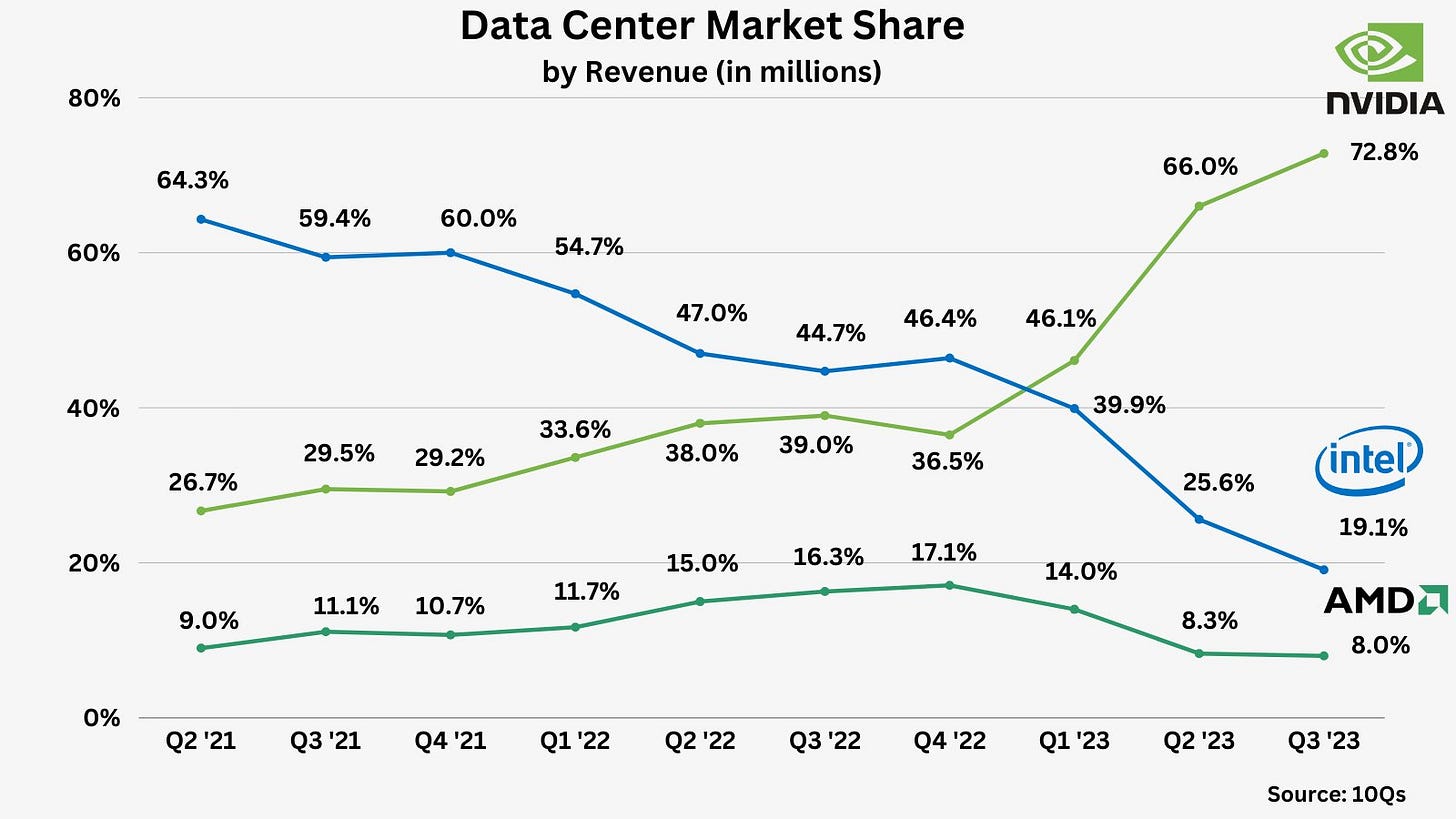

6. AMD

Headquarters: Sunnyvale, CA

Year Founded: 1969

Management:

Founders: Jerry Sanders, Frank Botte, Sven Simonsen, Larry Stenger, Jack Gifford, Edwin Turney, John Carey

CEO: Lisa Su, CTO Mark Papermaster

Enterprise Value: $198B

1Y Returns: +66%

5Y Returns: +473%

Annualized Revenue: $22.1B

Growth: 4% YoY (fluctuates with cyclicality and upgrade cycles, 32% 5 year CAGR)

Gross Margin: 47%

Annualized EBITDA: $0.8B, 3% margin

Headcount: 25,000

Products: GPU, CPU, DPU, FPGA, Adaptive SoC focused on the data center and software enablement that is primarily open-source

AI Tailwinds: High, given its position as the #2 GPU provider and the growth its seen in the data center over the past 5 years — though it is in a refresh cycle

What’s notable?: AMD is the only direct competitor to Nvidia, though its viability is tough to discern. See this post by Semi Analysis to read its views on competitiveness, and order volumes from MSFT, Meta, Oracle, Google, Amazon, etc.

Investor Presentation: See here

7. Intel

Headquarters: Santa Clara, CA

Year Founded: 1968

Management:

Founders: Gordon Moore, Robert Noyce

Patrick Gelsinger (CEO)

Enterprise Value: $187B

1Y Returns: 53%

5Y Returns: -10%

Annualized Revenue: $63B

Growth: -8% YoY

Gross Margin: 43%

Annualized EBITDA: $1.2B, ~2% margin

Headcount: 131,900

Products: CPUs, integrated CPU/GPU, accelerators

AI Tailwinds: Potentially negative, as GPU providers take share from CPU workloads

What’s notable?: Intel has somewhat missed out on the AI tailwinds and is losing share in the data center as a whole

Investor Presentation: see here

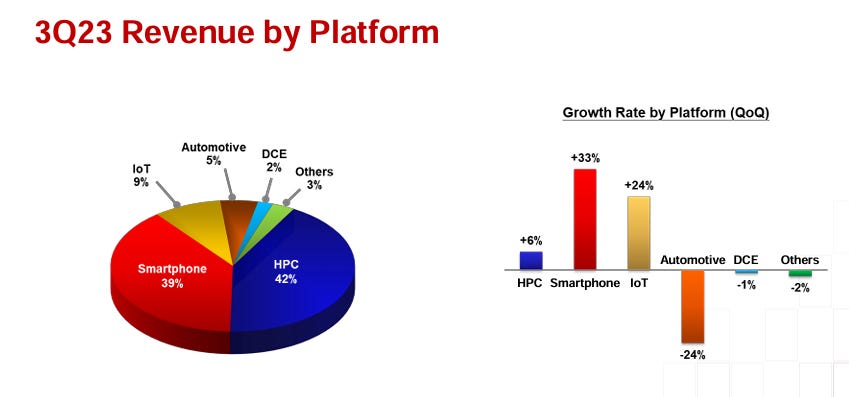

8. Qualcomm

Headquarters: San Diego, CA

Year Founded: 1985

Management:

Founders: Irwin Mark Jacobs, Andrew Viterbi, Franklin Antonio, Klein Gilhousen, Harvey White, Adelia A Coffman, Andrew Cohen

Cristiano Amon (CEO)

Enterprise Value: $141B

1Y Returns: 7%

5Y Returns: 117%

Annualized Revenue: $34.8B

Growth: -24% (10% average over past 5 years)

Gross Margin: 55%

Annualized EBITDA: $7.8B, ~22% margin

Headcount: 50,000

Products: intellectual property in mobile and handsets, automotive, and internet of things (IoT)

AI Tailwinds: Low to Medium, mainly AI on mobile devices, automotive, and IoT; not really in the data center

What’s notable?: Qualcomm is domiciled in San Diego, proving you indeed can be productive in paradise. Their mobile IP is used by nearly every major mobile player, including Apple and Samsung.

Investor Presentation: see here

9. Applied Materials

Headquarters: Santa Clara, CA

Year Founded: 1967

Management:

Founder: Michael A. McNeilly

Gary E. Dickerson (CEO), CTO: Omkaram Nalamasu

Enterprise Value: $124B

1Y Returns: +44%

5Y Returns: +297%

Annualized Revenue: $27B

Growth: flat YoY, 16% CAGR over last 4 years

Gross Margin: 47%

Annualized EBITDA: $7.7B, 28% margin

Headcount: 34,300

Products: Mainly equipment with key products include semiconductor wafer fabrication equipment and related process technologies, which are essential for the manufacturing of integrated circuits or chips. Additionally, they offer tools for advanced packaging, chemical mechanical planarization, and materials engineering, crucial for the production of flat panel displays, solar panels, and other electronic devices.

AI Tailwinds: Similar tailwinds as ASML, due to its role in advanced semiconductor manufacturing for AI technologies — though ASML focuses on photolithography for miniaturized, high-performance chips for AI while Applied Materials offers a broader range of semi fabrication solutions

What’s notable?: Applied Materials has the industry’s biggest installed base for equipment and has long-term subscription service agreements accounting for 63% of revenue and 90%+ renewal rates

Investor Presentation: see here

10. Arista Networks

Headquarters: Santa Clara, CA

Year Founded: 2004 (recently!)

Management:

Founders: Andy Bechtolsheim, Kenneth Duda, David Cheriton

Jayshree Ullal (CEO)

Enterprise Value: $68B

1Y Returns: +62.5%

5Y Returns: +264%

Annualized Revenue: $6.0B

Growth: +28% YoY

Gross Margin: 62%

Annualized EBITDA: $2.6B, 43% margin

Headcount: 3,612

Products: Cloud networking solutions, primarily switches and routers designed for large data center and campus environments. Products known for scalability, efficiency and integration with software-defined networking capabilities. Arista also provides network telemetry and analytics, as well as network automation tools, to optimize network performance and management.

AI Tailwinds: High, as Arista’s cloud networking solutions are integral for AI data processing and analytics in large-scale data centers. The company's emphasis on high-speed, scalable networks, and its integration of AI-driven analytics and automation tools, positions it well to cater to the growing demands of AI and machine learning workloads. Arista also is a key provider to major cloud providers Microsoft, Meta, Apple, Google, and Amazon.

What’s notable?: Andy Bechtolsheim is a well-known repeat entrepreneur and one of the original founders of Sun Microsystems, while David Cheriton is a respected computer scientist and professor at Stanford. Arista has usurped Cisco in many ways in its core business (Cisco arguably deserves to be on this list of Semiconductor companies, but given its complexity it was not included).

Investor Presentation: see here

11. Lam Research

Headquarters: Fremont, CA

Year Founded: 1980

Management:

Founder: David Lam

Timothy Archer (CEO)

Enterprise Value: $94B

1Y Returns: +61%

5Y Returns: +353%

Annualized Revenue: $17.4B

Growth: 16% 5 year CAGR

Gross Margin: 45%

Annualized EBITDA: $4.5B, 26% margin

Headcount: 17,200

Products: specializing in wafer fabrication equipment and services. Their products include etch systems, which are used to shape thin film layers on semiconductor wafers, and chemical vapor deposition (CVD) systems, crucial for creating high-quality semiconductor films. Major competitors of Lam Research in the semiconductor equipment sector include Applied Materials, KLA Corporation, and ASML, all of which provide various specialized equipment and solutions for semiconductor manufacturing.

AI Tailwinds: medium to high compared to its peers in the semiconductor equipment industry. The company's focus on advanced wafer fabrication technologies is increasingly important for producing the sophisticated chips required in AI and machine learning applications, positioning it well in the AI-driven semiconductor market, though not as directly involved in AI-specific developments as some specialized chip manufacturers.

What’s notable?: Lam is distinguished for its innovation and leadership in semiconductor fabrication equipment, particularly in etch and deposition technologies, which are critical for the manufacturing of advanced integrated circuits. The company's sustained commitment to research and development has led to significant breakthroughs in semiconductor processing, contributing to the miniaturization and increased performance of electronic devices.

Investor Presentation: see here

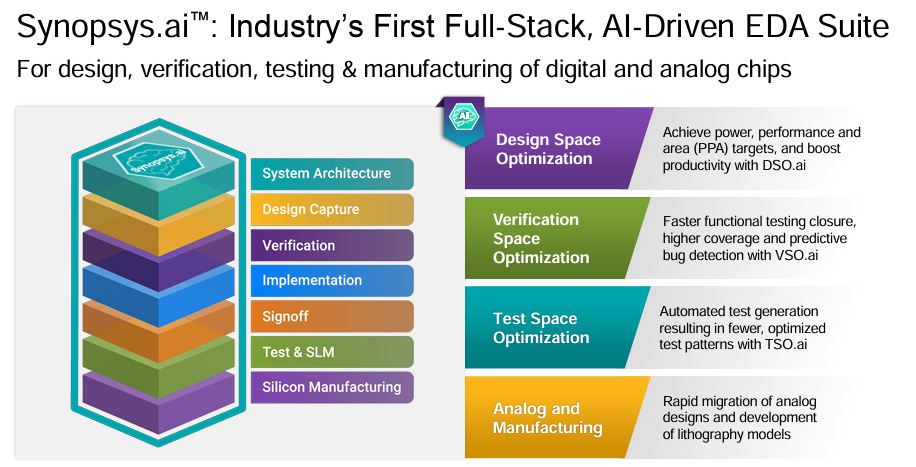

12. Synopsys

Headquarters: Mountain View, CA

Year Founded: 1986 (semi recently along with Cadence!)

Management:

Founder: Aart de Geus

Aart de Geus (May 23, 2012–), Chi-Foon Chan (May 23, 2012–)

Enterprise Value: $83B

1Y Returns: +68%

5Y Returns: +492%

Annualized Revenue: $5.8B

Growth: 14%

Gross Margin: 80%

Annualized EBITDA: $1.3B, ~21% margin

Headcount: 19,000

Products: Software for

AI Tailwinds: High, as its EDA software and intellectual property services are necessary for the growing complexity of semiconductor designs driven by AI and machine learning demands. It is favorably positioned with Cadence as its major rival, while the 3rd distant player Mentor Graphics (now part of Siemens) is quite behind in all things AI-driven design and verification.

What’s notable?: The company has a very blue chip, diversified customer base with virtually all the top semiconductor companies and all of the top 20 — where no single customer represents more than 10% of revenue. It competes head to head with Cadence which are a duopoly and the purest software plays.

Investor Presentation: see here

13. Cadence Design Systems

Headquarters: San Jose, CA

Year Founded: 1988 (not too long ago!)

Management:

Founders: Alberto Sangiovanni-Vincentelli, A. Richard Newton

Anirudh Devgan (CEO)

Enterprise Value: $74B

1Y Returns: +65%

5Y Returns: +501%

Annualized Revenue: $4.1B of ARR

Growth: 14%

Gross Margin: 92%! Software

Annualized EBITDA: $1.2B, ~29% margin

Headcount: 10,200

Products: range of products primarily focused on electronic design automation (EDA), including software, hardware, and IP for designing integrated circuits, systems on chips, and printed circuit boards. Their products are widely used in designing advanced semiconductor chips across various industries. Cadence's main customers are semiconductor and electronics companies like AMD, and NVIDIA, as well as various other chip manufacturers and electronics designers.

AI Tailwinds: High, as its AI-driven software tools enhance the efficiency and effectiveness of chip design, which is only becoming more complex. These advancements are particularly significant in the rapidly evolving sectors of semiconductor design and high-performance computing, where AI and machine learning algorithms are increasingly crucial for optimizing design processes and enabling more complex, efficient chip architectures.

What’s notable?: Cadence, like Synopsys, is arguably is pureplay software company in the realm of chip design with one of the largest moats in all of software. The Company has made a number of acquisitions over the years to bolster its portfolio, as has Synopsys.

Investor Presentation: see here

14. KLA Corporation

Headquarters: Milpitas, CA

Year Founded: 1975

Management:

Founders: (1997, merger of KLA and Tencor)

Richard P. Wallace (CEO)

Enterprise Value: $74.4B

1Y Returns: +46%

5Y Returns: +455%

Annualized Revenue: $10.2B

Growth: 23% 5 year CAGR

Gross Margin: 60%

Annualized EBITDA: $3.8B, ~37% margin

Headcount: 15,000

Products: specializing in process control and yield management solutions. Products include advanced inspection and metrology systems that are essential for semiconductor wafer manufacturing, helping to detect defects and improve overall chip quality. KLA also offers analytical and measurement systems for various stages of semiconductor production, from research and development to final manufacturing, catering to the needs of chipmakers for efficient and high-precision production processes.

AI Tailwinds: Medium, as the company's metrology and inspection technologies are increasingly integrating AI to enhance semiconductor manufacturing processes, its core focus on process control, rather than direct AI chip development, positions it with moderate AI-driven growth potential relative to companies directly producing AI-specific semiconductors.

What’s notable?: Leading role in process control and yield management solutions, which are critical for ensuring the quality and efficiency of semiconductor manufacturing, with its biggest customers being TSMC, Samsung and Intel.

Investor Presentation: see here

15. Marvell

Headquarters: Santa Clara, CA

Year Founded: 1995 (not that long ago!)

Management:

Founders: Sehat Sutardja, Weili Dai, Pantas Sutardja

Richard S. Hill, (Chairman), Matthew Murphy (President and CEO)

Enterprise Value: $48B

1Y Returns: +29%

5Y Returns: +245%

Annualized Revenue: $5.6B

Growth: 19% 5 year CAGR

Gross Margin: 39%

Annualized EBITDA: $2.7B, ~48% margin

Headcount: 7,448

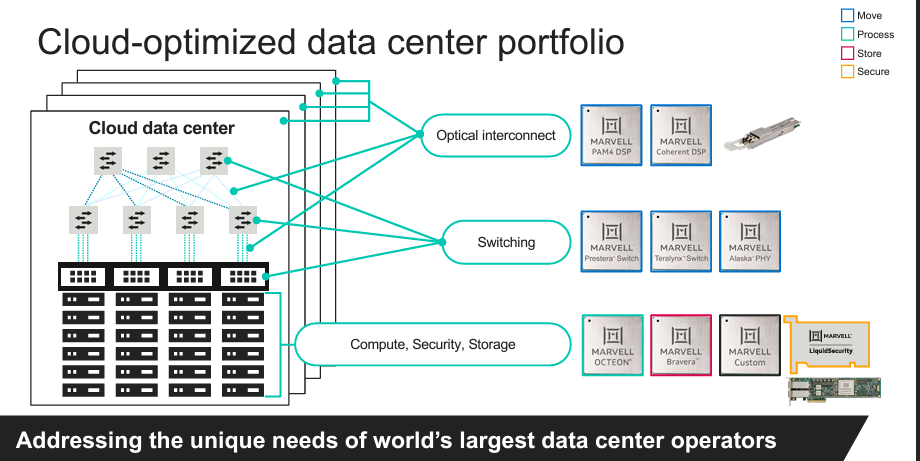

Products: Focus on networking and storage solutions, with a product portfolio that includes high-performance processors, switches, and controllers used in data centers, enterprise networks, and cloud computing services

AI Tailwinds: Medium, as the company operates in the data center, automotive and telecommunications applications — though the company is less directly focused on AI-specific chips and technologies than peers like Nvidia, AMD, etc.

What’s notable?: Marvell's strategic acquisitions, like that of Inphi Corporation, have significantly expanded its portfolio and capabilities in high-speed data movement, further cementing its status in the semiconductor industry.

Investor Presentation: see here

If you are interested in finding long-term compounders in the semiconductor landscape, I recommend reviewing the Rule of 40 scores for each above. My personal favorite companies are Nvidia, Broadcom, TSMC, ASML, Arista Networks, Synopsys, and Cadence. I also like Lam Research, Applied Materials, KLA, AMD and Marvell — though a tad less due to less direct AI exposure, competitive dynamics, and capital intensity. Note the semiconductor industry can be cyclical and is currently in a boom period, so dollar cost averaging is recommended if investing.

We will have follow up pieces on individual companies mentioned in this report in the future. Send me a note if there are particular companies you are interested in.

If you are a founder or practitioner building semiconductors for AI and the data center, I’d love to meet you!

Nice breakdown!