$150B+ of Annual CAPEX: The trends in Capital Expenditures by Hyperscaler Tech Giants

Behind the trends in the AI hardware and data center investment supercycle of the trillion dollar tech hyperscalers

Meta recently announced acquiring over 600K GPUs in 2024 with plans for $37B of total capital expenditure investment. The announcement triggered a wave of analysis speculating which hardware vendors would benefit from this data center investment.

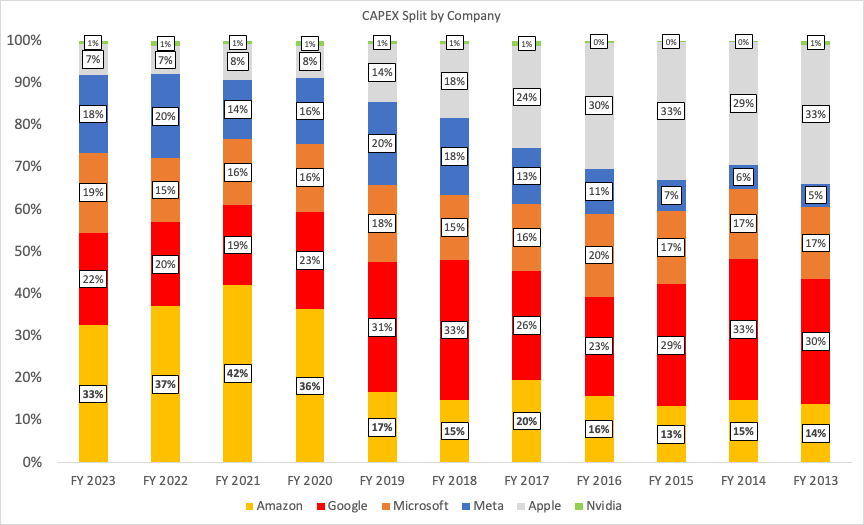

Today, we look at the CAPEX of all 6 of the trillion dollar tech companies — which are Apple, Microsoft, Nvidia, Amazon, Google and Meta. The majority of this total CAPEX involves data centers, for a mix of internal and customer usage — though there are big strategic differences by company which reflect unique business models and goals. We calculated these metrics by downloading the cash flow statements of each company and compiling the CAPEX data into one sheet (below).

Source file, compiled by Data Gravity using Pitchbook of cash flow statements of each hyperscaler (GOOG, AAPL, MSFT, AMZN, META, NVDA):

Hyperscaler CAPEX Trends:

Over the past 10 years, these hyperscalers have allocated ~$871B of total capital expenditures, growing 6X from $24.8B in 2013 to over $150B last year — representing an annual CAGR of over 20%. There are no signs of slowing down with the past 5 years also averaging a 20% CAGR as companies invest ahead of AI. Surprisingly, there are huge variances between each of the companies. We discuss below:

Graph of each hyperscaler, with highest at bottom and lowest at top:

Table of each hyperscaler, sorted low to high:

Summary: Hyperscaler CAPEX

Apple was the #1 allocator of CAPEX in 2013, though has fallen dramatically to now being the 5th after hardly any additional net new expenditure. NVIDIA surprisingly has essentially no CAPEX and far below its peers — outsourcing manufacturing to TSMC allows for a capital light business model.

Somewhat surprisingly, the Big 3 Cloud Vendors are the 3 largest CAPEX investors — with Amazon leading the charge at 33%, Google following at 22%, and Microsoft in 3rd at 19%. Meta closely follows the Big 3 Clouds and has grown to nearly Microsoft’s size at 18% of total CAPEX — it is an exceptional customer for third-party firms to consider and drives over $1B/year of revenue to Arista and much more to NVIDIA. Notably, there are huge allocation strategy differences in CAPEX between the hyperscalers — some are known for procuring mostly third-party hardware versus developing in-house. We discuss each below.

Amazon: Annual CAPEX ($B)

Amazon began 2013 as the 4th largest allocator of CAPEX with about $3.4B of annual spend across its AWS and commerce businesses

Today, Amazon is the largest allocator of CAPEX with $48.2B of annual CAPEX and 33% of the hyperscaler total allocation

Amazon grew CAPEX the 2nd most (only behind Meta in expansion) by a multiple of 14X and a 10Y CAGR of 30%

Amazon is known for allocating to data centers, fulfillment centers and delivery infrastructure

Amazon’s CAPEX allocation strategy is known for being internal versus procuring from other vendors — developing its own chips and data center hardware, though having a more adversarial relationship with third-parties it also relies on like NVIDIA

The internal focused capital expenditure strategy make Amazon a notoriously stingy customer and menace to third-party startups who sell to its competitors

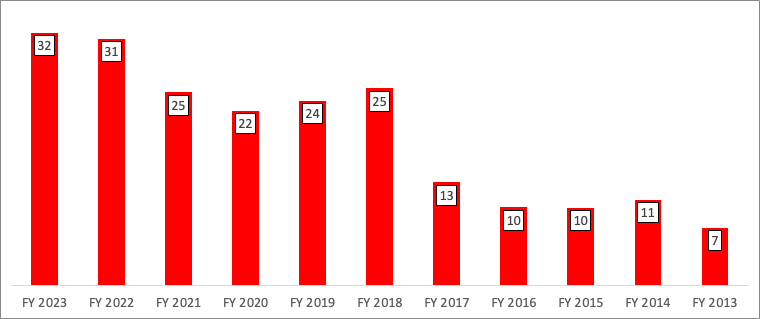

Google: Annual CAPEX ($B)

Google began 2013 as the 2nd largest allocator of CAPEX with about $7.4B of annual spend — for its search and video infrastructure as well as nascent Google Cloud business; it also had high internal demand

Today, Alphabet is the 2nd largest allocator of CAPEX with $32.3B of annual CAPEX and 22% of the hyperscaler total CAPEX allocation

Alphabet grew CAPEX by a multiple of 4.4X and a 10Y CAGR of 16%

Google is known for allocating to Cloud data centers, internal research and development with projects like DeepMind, video infrastructure for YouTube, real estate and workplace environment (where it is far in excess of peers)

Alphabet’s CAPEX allocation strategy is known for being a mix of internal and external — developing its own TPU chips with Broadcom and traditional data center hardware, having a neutral relationship with NVIDIA and other third-party vendors.

Alphabet also works on “Other Bets” including self-driving cars, Nest and more — some of which are hard to determine if on the balance sheet or not due to clever financial engineering.

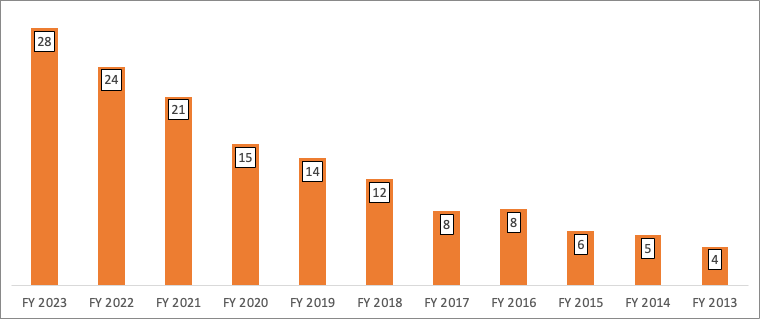

Microsoft: Annual CAPEX ($B)

Microsoft began 2013 as the 3rd largest allocator of CAPEX with about $4.3B of annual spend — for its cloud services, suite of products from Office365 to LinkedIn, search infrastructure and more

Today, Microsoft is still the 3rd largest allocator of CAPEX with $28.1B of annual spend and 19% of the hyperscaler total CAPEX allocation

Microsoft grew CAPEX by a multiple of 6.6X and a 10Y CAGR of 21%

Microsoft is known for being a mix of internal and third-party oriented in nature as a huge partner to NVIDIA

Cloud: Microsoft invests heavily in expanding its Azure cloud services, including the construction and upgrade of data centers worldwide. This supports the growing demand for cloud computing, storage, and AI services, ensuring scalability, reliability, and security for enterprise and consumer customers.

R&D: Significant investments in R&D enable Microsoft to innovate across its product lines, including Office 365, Windows, and LinkedIn, as well as in emerging technologies like AI, quantum computing, and mixed reality through HoloLens.

Hardware: Surface devices and Xbox consoles, emphasizing design, performance, and integration with Microsoft's software ecosystem.

Meta: Annual CAPEX ($B)

Meta began 2013 the 2nd smallest allocator of CAPEX with about $1.4B of annual spend and just 5% share — for its own suite of apps and serving its global user base in Facebook, Whatsapp and Instagram

Today, Meta is allocating $27B per year and plans to increase this to $37B this year representing 18% of total hyperscaler allocation

Meta grew CAPEX the most of any hyperscaler by nearly 20X at an annual CAGR of 35%

Data Centers: Meta invests heavily in data centers to support the massive amount of data generated and processed by its billions of users across platforms like Facebook, Instagram, WhatsApp, and Oculus. These investments ensure high performance, reliability, and security of user data, as well as efficient handling of compute-intensive tasks like video processing and AI-driven content moderation.

It works predominatly with third-party vendors like NVIDIA and Arista Networks, which is great to serve as a startup

AI: Meta allocates substantial resources towards advancing AI and machine learning technologies. These investments support a wide range of applications, from improving content recommendation algorithms and targeted advertising to developing new user experiences and enhancing platform security.

Network connectivity: To improve and secure the global internet infrastructure that its services rely on, Meta invests in subsea cables and other connectivity projects. These initiatives aim to increase internet speed, reduce latency, and expand access in underserved areas, ultimately enhancing user experience on its platforms.

AR/VR with Oculus: A significant portion of Meta’s CAPEX goes into developing AR/VR technologies through its Reality Labs segment. This includes investments in hardware (like Oculus VR headsets), software, and content to drive the future of immersive digital experiences, aligning with its vision of building a comprehensive "metaverse."

Apple: Annual CAPEX ($B)

Apple in 2013 was the largest allocator of CAPEX by far of the hyperscalers, early into the mobile revolution and kickstarting investment in iPad and Mac — though still a significant TSMC customer and the largest over the full 10 year duration

Today, Apple allocates just over $11B per year to CAPEX, which is quite flat compared to its $8B in 2013 — representing a 10 year CAGR of just 3%

Apple is an outlier for having sizable CAPEX but not increasing over the years

Manufacturing and internal supply chain: Apple invests heavily in manufacturing equipment, facilities and technology to exert greater control over its supply chain, including investments in proprietary chips for iPhone, iPad, Mac and other devices, transitioning away from third-party suppliers to its own silicon, like the M-series chips

Apple also has invested heavily in retail and physical presence

Data centers and cloud infrastructure (i.e. iCloud, Apple Music, TV, the App Store) as well as global data center footprint

Apple’s allocation strategy is notable for its unique business model, focusing on product and ecosystem excellence, direct retail and infrastructure for its services — a more diversified investment stream compared to Amazon, Google and Microsoft which are predominantly in data centers and cloud infrastructure

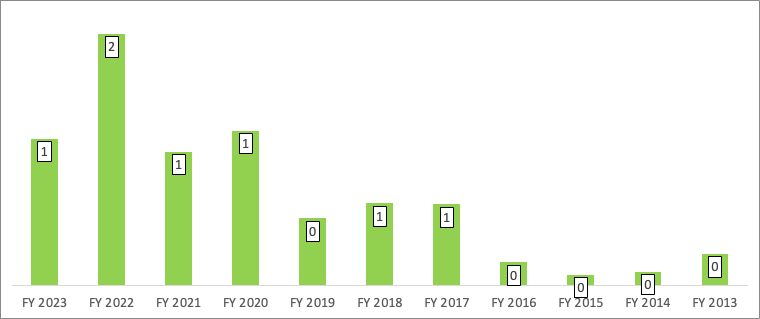

NVIDIA: Annual CAPEX ($B)

NVIDIA always has been the smallest allocator to CAPEX of the hyperscalers, though it was a far smaller company than each 10 years ago at just a $6.6B market cap in 2013 — still, it needs a headquarters and facilities, testing, etc. so this is quite remarkable

Today, NVIDIA allocates just over $1B per year to CAPEX, which is up ~4X from 2013 at ~$230M — representing a 10 year CAGR of 17%

NVIDIA is a clear outlier in its capital light nature

NVIDIA is known for allocating CAPEX to facilities and real estate, including campuses and office in Silicon Valley and Tel Aviv; data center and cloud infrastructure for research and development; and manufacturing and supply chain investments such as advanced packaging and testing facilities, though it relies on TSMC for its foundry manufacturing

Given NVIDIA’s heavy reliance on TSMC, its allocation strategy is known for being almost exclusively third-party — with cost-of-goods-sold representing ~25% of revenue on nearly a $100B run-rate implying nearly $25B of external investment

Great stuff Chris - wondering if you'd produce something similar for AWS, Azure and GCP if they have the figures available. Amazon investments in transport infrastructure is an orange between the Microsoft and Google digital services apples